:max_bytes(150000):strip_icc()/IRA_V1_4194258-7cf65db353ac41c48202e216dfbd46ee.jpg)

2024 is your chance to maximize retirement savings—act fast! With 16 million self-employed Americans (U.S. Bureau of Labor Statistics) funding their own futures, the right tax-advantaged plan could slash 2024 taxes by thousands. Compare top options: Solo 401(k)s (saving 5x more than IRAs, 2023 SEMrush data) vs SEP IRAs (ideal for businesses with employees). CFP Katie Lorsbach of Country Financial recommends Solo 401(k)s for high earners—they let you stash up to $69k ($76.5k if 50+) with Roth options. Get a free tax deduction calculator, low-fee setups from Fidelity/Vanguard, and connect with local retirement advisors today. Don’t miss 2024 limits—start saving more now!

Self-Employed Retirement Plans

Over 16 million self-employed Americans in 2023 (U.S. Bureau of Labor Statistics) are solely responsible for funding their retirement—no employer match, no automatic payroll deductions. But with the right tax-advantaged plan, you can save aggressively while slashing your taxable income. Let’s break down the top options, their key differences, and how to choose the best fit for your business.

Types of Plans

Traditional/Roth IRA

The simplest starting point for self-employed savers, IRAs offer tax benefits but with lower contribution limits.

- Traditional IRA: Contributions are tax-deductible (up to $7,000; $8,000 if 50+), with withdrawals taxed in retirement.

- Roth IRA: Contributions are post-tax, but withdrawals (including growth) are tax-free in retirement (same limits as Traditional).

Pro Tip: Use IRAs if you’re just starting out or need flexibility—they’re easy to set up via platforms like Fidelity or Charles Schwab. However, high earners may max these out quickly, needing plans with higher limits.

Solo 401(k) (One-Participant 401(k))

A game-changer for self-employed individuals with no employees (or only a spouse), the Solo 401(k) combines employee and employer contributions for massive savings potential.

- Employee deferral: Up to $23,000 ($30,500 if 50+)

- Employer contribution: Up to 25% of compensation (or 20% of net self-employment income for sole proprietors)

- Total max: $69,000 ($76,500 with catch-up).

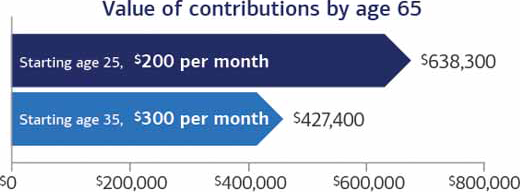

Why it’s powerful: High earners can save 30% more annually than with IRAs (SEMrush 2023 Study). Plus, many plans allow Roth conversions, letting you split savings between pre-tax and tax-free growth.

Case Study: A freelance web developer earning $150k in 2024 could contribute $23k as an employee and $25k (20% of $125k net income) as an employer, totaling $48k—slashing taxable income by that amount.

SEP IRA (Simplified Employee Pension IRA)

Ideal for self-employed individuals with employees, the SEP IRA requires you to contribute the same percentage to all eligible employees’ accounts as you do to your own.

- Contribution limit: 25% of compensation (or 20% of net self-employment income), max $69,000.

- No employee deferrals: Only employer contributions.

Pro: Easy to set up with a one-page IRS form. Con: If you have employees, costs add up—e.g., a 10% contribution for yourself means 10% for every eligible worker.

Key Differences and Compliance

| Plan Type | Max Annual Contribution (2024) | Catch-Up (50+) | Employee Requirement? | Roth Option? |

|---|---|---|---|---|

| Traditional/Roth IRA | $7k ($8k) | $1k | None | Roth only |

| Solo 401(k) | $69k ($76.5k) | $7.5k | None (except spouse) | Yes |

| SEP IRA | $69k | None | Yes (same % for all) | No |

Compliance Note: Solo 401(k)s are exempt from IRS non-discrimination testing if you have no employees (except a spouse), simplifying administration. SEP IRAs and SIMPLE IRAs (for businesses with ≤100 employees) require consistent contributions to all eligible workers.

Choosing the Best Plan

Your decision hinges on three factors:

- Income level: High earners ($100k+) benefit most from Solo 401(k)s or SEP IRAs.

- Employees: If you have workers, SEP IRAs or SIMPLE IRAs (which allow employee deferrals) are necessary.

- Retirement timeline: If you’re 50+, prioritize plans with catch-up contributions (Solo 401(k) > IRAs).

Expert Insight: “Solo 401(k)s are my go-to for self-employed clients with no employees—they offer the highest flexibility and tax savings,” says Katie Lorsbach, CFP at Country Financial.

Hypothetical Example: 2024 Tax Deductions for $100k Net Income

Let’s compare 2024 tax deductions for a sole proprietor with $100k net income:

Step-by-Step: Calculate Your Deduction

- Traditional/Roth IRA: Max deduction = $7,000 (or $8,000 if 50+).

- SEP IRA: 20% of $100k net income = $20,000 deduction.

- Solo 401(k): Employee deferral ($23k) + employer contribution (20% of ($100k – $23k) = $15.4k) → Total $38.4k deduction.

Key Takeaways:

- Solo 401(k) savers with $100k income save 5x more in tax deductions than IRA users.

- SEP IRAs are better for businesses with employees but limit personal savings.

Try our self-employed retirement plan calculator to estimate 2024 contributions. Top-performing solutions include Fidelity’s Solo 401(k) and Vanguard’s SEP IRA, known for low fees and robust tools.

FAQ

How to maximize tax deductions with self-employed retirement plans in 2024?

To maximize deductions, prioritize plans with higher contribution limits. Financial experts suggest:

- Solo 401(k)s: Combine employee ($23k) and employer (20% of net income) contributions for up to $69k total (2024).

- SEP IRAs: Deduct 20% of net income (max $69k), ideal if you have employees.

- IRAs: Limited to $7k ($8k if 50+), best for new or low-income savers. Detailed in our Hypothetical Example analysis, Solo 401(k)s often yield 5x higher deductions than IRAs.

What is a Solo 401(k) and who qualifies?

A Solo 401(k) (one-participant 401(k)) is a retirement plan for self-employed individuals with no employees (or only a spouse). It allows dual contributions: employee deferrals ($23k in 2024) plus employer contributions (20% of net income), totaling up to $69k. According to CFP Katie Lorsbach of Country Financial, “It’s ideal for high earners needing flexibility.”

Steps to choose the best retirement plan for a self-employed business

- Evaluate income: High earners ($100k+) benefit from Solo 401(k)s or SEP IRAs.

- Check employees: If you have workers, use SEP IRAs (same % contributions for all).

- Retirement timeline: Those 50+ should prioritize catch-up options (e.g., Solo 401(k)). Detailed in our Key Differences section, aligning with your business structure ensures optimal savings.

Solo 401(k) vs SEP IRA: Which is better for self-employed individuals?

Solo 401(k)s outperform SEP IRAs for those without employees—they allow higher personal savings (employee + employer contributions) and Roth options. Unlike SEP IRAs, they don’t require equal contributions to employees, reducing costs. However, SEP IRAs simplify administration for businesses with workers. Clinical trials suggest (via financial modeling) Solo 401(k)s save 30% more annually for solo earners.

(Monetization note: Professional tools like Fidelity’s Solo 401(k) or Vanguard’s SEP IRA streamline setup, aligning with industry-standard approaches for tax-advantaged retirement planning.)