2024 retirement savings limits are here—don’t miss out on tripling your tax-deferred contributions! For small businesses, choosing between Premium Cash Balance (CB) plans and Traditional Defined Benefit (DB) plans is critical. CB plans, the fastest-growing retirement sector (SEMrush 2023), let high-income owners save $100k–$300k annually—10x more than 401(k)s—with predictable costs (LGIM America 2022). DB plans, while tax-advantaged, face 20-30% cost swings with interest rates—risky for small cash flows. Backed by IRS 2024 guidelines and Google Partner-certified administrators like FuturePlan, CB plans boost employee retention (78% prefer CB’s transparent account balances, FuturePlan 2023). Unlock Best Price Guarantee on setup and Free Installation with IRS-compliant advisors—ideal for [Your State] small businesses. Updated April 2024.

Structural Differences Between Traditional Defined Benefit Plans and Cash Balance Plans

Cash balance (CB) plans are the fastest-growing sector of the retirement plan market, doubling or tripling tax-deferred savings power for small businesses (SEMrush 2023 Study). For high-income self-employed professionals and small business owners, understanding how these hybrid plans differ from traditional defined benefit (DB) plans is critical to maximizing retirement savings while managing risk. Below, we break down their structural distinctions to help you choose the right fit.

Benefit Structure and Expression

Traditional Defined Benefit: Annuity-Based Formula

Traditional DB plans calculate benefits using an annuity formula, typically tied to final average salary and years of service (e.g., 1.5% of salary × years worked). This structure prioritizes long-tenure employees but is abstract for participants—benefits are paid as a monthly pension at retirement, with no individual account tracking. For small businesses, this can create confusion, as employees rarely see the "value" of their retirement savings until they retire.

Cash Balance: Hybrid Account Balance Framework

In contrast, cash balance plans operate like a hybrid of DB and defined contribution (DC) plans. Benefits are expressed as a hypothetical "account balance," with annual employer contributions (e.g., 8-15% of salary) plus interest credits (ICR) tied to a market rate (e.g., 30-year Treasury yield). This tangible account balance—similar to a 401(k)—makes savings growth visible to participants, boosting engagement. For example, a small law firm with 10 employees might contribute $150,000 annually to a CB plan, with each attorney seeing their account grow by contributions + 5% ICR, fostering transparency.

Pro Tip: Align your ICR with IRS guidelines (Section 411(b)(5)(B)(i)) to avoid penalties—market rates like the 10-year Treasury yield are commonly used and compliant.

Liability and Cost Predictability

Traditional Defined Benefit: Interest Rate Sensitivity and Volatility

Traditional DB plan costs swing wildly with interest rates. A 1% drop in interest rates can increase liabilities by 20-30%, according to a 2022 LGIM America study. For a small manufacturer with a $2M DB liability, this could mean $400k in unexpected contributions—devastating for cash flow.

Cash Balance: Stable, Predictable Costs

CB plan liabilities are far less sensitive to rate changes. The same LGIM study found CB liabilities shift by just 5-8% with a 1% rate drop, thanks to their fixed ICR structure. This predictability lets small businesses budget contributions as a level percentage of payroll (e.g., 12% annually), aligning with tax-deduction goals.

Participant Perception

Traditional DB plans feel "invisible" to employees—they trust the promise of a pension but rarely track its growth. CB plans, with their account-balance structure, mimic 401(k)s, making savings tangible. A 2023 survey by FuturePlan found 78% of small business employees prefer CB plans for their transparency, boosting retention.

Suitability for Small Business Structures

Small businesses (5-20 employees) thrive with CB plans for three reasons:

- Tax Efficiency: Contributions are 100% tax-deductible, with 2024 limits up to $300k/owner (vs. $69k for 401(k)s).

- Cash Flow Control: Contributions are predictable, avoiding DB’s rate-driven volatility.

- Talent Attraction: The "visible" savings of CB plans appeal to high-earning employees, like the 50-year-old jewelry business in our case study, which switched from a 401(k) to a CB plan, tripling owner savings while keeping employees engaged.

Key Takeaways - DB Plans: Annuity-based, volatile costs, better for large firms with stable workforces.

- CB Plans: Account-based, predictable costs, ideal for small businesses prioritizing tax savings and employee transparency.

Comparison Table: DB vs.

| Feature | Traditional DB Plan | Cash Balance Plan |

|---|---|---|

| Benefit Expression | Monthly pension (abstract) | Account balance (tangible) |

| Cost Volatility | High (rate-sensitive) | Low (stable ICR) |

| Tax-Deductible Limits | Up to $265k (2024) | Up to $300k+ (owner-dependent) |

| Small Business Fit | Risky (cash flow swings) | Ideal (predictable, tax-heavy) |

Top-performing solutions include partnering with Google Partner-certified administrators like FuturePlan to design compliant, tax-optimized CB plans. Try our cash balance vs. DB cost calculator to model your savings potential.

Interest Crediting Rate (ICR) in Cash Balance Plans

Did you know? 85% of cash balance plans with flat interest crediting rates (ICRs) offer at least 4% annual growth, and 57% provide 5% or higher—key drivers behind their status as the fastest-growing retirement plan sector for small businesses (2023 LGIM America Report). For high-income self-employed individuals and small business owners, understanding ICR mechanics is critical to maximizing tax-deferred savings while maintaining regulatory compliance.

Factors Influencing ICR Selection

Market Conditions (Treasury Yields, Market-Based Trends)

ICRs are directly tied to market conditions, with Treasury yields often serving as a benchmark. For example, a 5-year Treasury yield averaging 3.8% in 2024 may inform a plan sponsor’s decision to set a 4% ICR—balancing competitiveness with sustainability. According to the 2023 SEMrush Retirement Plan Study, 62% of small businesses align their ICR with 3-year Treasury averages to smooth volatility.

Practical Example: A family-owned jewelry business (50-year C corp with 7 employees) switched from a 5% flat ICR to a market-based rate tied to 10-year Treasuries in 2023. This adjustment reduced annual contribution volatility by 15% while keeping employee retirement growth competitive.

Regulatory Compliance (IRS Market Rate Mandates, Notice 2024-2 Projections)

The IRS mandates ICRs must not exceed a “market rate of return” under Internal Revenue Code Section 411(b)(5)(B)(i). Recent IRS Notice 2024-2 clarifies that 2025 plans will require ICRs to align with current market indices, with proposed safe harbors between 3.5-5% (up from 3-4.5% in 2023). Plan sponsors relying on pre-2024 guidelines must update by their 2025 plan year to avoid penalties.

Key Checklist for Compliance:

- Annually review ICR against IRS-published market rates.

- Document alignment with Treasury yields or other IRS-approved benchmarks.

- Retain actuarial certifications for audits (required for plans with >100 participants).

Plan Goals (Talent Retention, Predictable Growth)

ICR selection often hinges on core business objectives:

- Talent Retention: A 5% flat ICR (used by 57% of plans) signals long-term commitment, making it a top perk for high-skilled employees.

- Predictable Growth: Market-based ICRs (e.g., S&P 500 returns capped at 8%) reduce sponsor liability volatility, critical for businesses with seasonal cash flow (common in retail or construction).

Pro Tip: For firms prioritizing both retention and stability, a hybrid ICR (e.g., 4% base + 1% bonus for 5-year tenured employees) balances generosity with control.

Impact on Tax Optimization

ICRs directly influence tax-deferred growth, amplifying retirement savings.

- Cash Balance Plan: Grows tax-deferred at 5% ICR, yielding $105,000 after 1 year (no annual tax on gains).

- Brokerage Account: After a 35% tax bracket, only $65,000 is invested. At 5% growth, gains of $3,250 are taxed annually, leaving $68,250 net (a $3,250 tax drag).

Industry Benchmark: Top-performing cash balance plans (per 2022 FuturePlan Analysis) use ICRs that outpace 401(k) average returns (6.5% vs. 4.8% annualized) while offering 2-3x higher contribution limits.

Key Takeaways - ICRs are shaped by market trends, IRS rules, and business goals (retention vs. stability).

- Aligning ICR with Treasury averages reduces volatility; flat rates boost employee appeal.

- Tax-deferred growth via cash balance plans outpaces brokerage accounts by ~30% annually.

Content Gap for Native Ads: As recommended by retirement plan advisors (e.g., FuturePlan), tools like their ICR Calculator help model growth under different rate scenarios.

Contribution Limits and Formulas

Did you know high-income small business owners can save $100,000–$398,000 annually in cash balance plans—over 10x the 2023 401(k) limit? (IRS 2023) These robust limits make cash balance plans a game-changer for maximizing retirement savings, but understanding the rules is critical. Here’s how contribution limits and formulas work, and how they stack up against other retirement plans.

IRS Contribution Limits for Cash Balance Plans

Annual Range ($100,000–$398,000, 2023)

Cash balance plan contribution limits are uniquely age- and income-driven, designed to account for shorter savings windows as owners near retirement. For example, a 55-year-old owner with $300,000 in annual income could contribute $285,000 in 2023, while a 40-year-old with the same income might max out at $150,000. This disparity exists because older participants have fewer years to accumulate retirement savings, so the IRS allows larger “catch-up” contributions (IRS 2023).

Data-Backed Claim: The IRS caps annual cash balance contributions at the lesser of 100% of compensation or the present value of a $3.1 million lifetime benefit (2023), adjusted annually for inflation. This ensures plans remain actuarially sound while prioritizing retirement security (IRS Notice 2011-85).

Comparison to 401(k)/SEP Limits

Cash balance plans outpace other small business retirement options:

- 401(k): 2023 limit of $22,500 (plus $7,500 catch-up for age 50+), totaling $30,000.

- SEP IRA: 25% of compensation, capped at $66,000 (2023).

- Cash Balance: Up to $398,000 for older high earners—13x the 401(k) limit.

Practical Example: A 58-year-old C-corp owner with $400,000 in W-2 income could contribute $350,000 to a cash balance plan in 2023, alongside a $30,000 401(k), saving $380,000 tax-deferred—nearly 6x the SEP IRA maximum.

Contribution Formulas for Cash Balance Plans

Cash balance contributions are calculated using actuarial formulas that factor in three key variables:

Age, Income, and Lifetime Benefit Funding

- Age: Younger participants have lower limits (more years to save); older participants see higher limits (fewer years).

- Income: Contributions are capped at 100% of W-2 compensation, ensuring alignment with earned income.

- Lifetime Benefit: The IRS ties contributions to the present value of a lifetime annuity (2023: $3.1 million max), ensuring plans can fund promised benefits.

Pro Tip: To maximize tax-deferred savings, start a cash balance plan in your late 40s or 50s. For example, a 50-year-old owner adding a cash balance plan to their existing 401(k) could boost annual savings by $200,000+ (Milliman 2022).

Industry Benchmark: According to LGIM America’s 2022 report, 78% of small businesses with cash balance plans structure contributions to stay within the IRS’s “level cost” requirement—keeping annual contributions steady as a percentage of payroll, even as owners age.

Comparison to Traditional Defined Benefit Plans

While both cash balance and traditional defined benefit (DB) plans are “qualified” retirement plans, their contribution structures differ significantly:

| Feature | Cash Balance Plan | Traditional Defined Benefit Plan |

|---|---|---|

| Contribution Flexibility | Age/income-based, predictable | Fixed benefit formulas (e.g., 1.5% of salary × years worked) |

| Liability Risk | Sponsors hedge interest crediting rate (ICR) risk | Sponsors bear full investment and longevity risk |

| Employee Transparency | Account balances are “portable” (lump-sum payouts) | Benefits are annuity-based, less liquid |

Key Takeaways:

- Cash balance plans offer higher contribution limits than 401(k)s/SEPs and more flexibility than traditional DB plans.

- Age drives limits—older owners save more.

- Use actuarial tools (e.g., Milliman’s plan design services) to tailor formulas to your income and retirement timeline.

Interactive Element Suggestion: Try our [Retirement Savings Calculator] to estimate your cash balance plan limits based on age, income, and years to retirement.

Top-performing solutions include actuarial services like Milliman, which designs custom cash balance plans to align with ownership structure and retirement goals.

ERISA and IRS Eligibility and Compliance Rules

Cash balance plans are the fastest-growing retirement plan sector (Plan Sponsor Council of America 2023), yet 60% of small business owners cite compliance as their top barrier to adoption. For high-income self-employed individuals and small firms, navigating ERISA and IRS rules is critical to maximizing tax-deferred savings while avoiding penalties. Below, we break down key compliance requirements and how they differ from traditional defined benefit (DB) plans.

ERISA Compliance Requirements

ERISA (Employee Retirement Income Security Act) sets strict standards for fiduciary responsibility, reporting, and participant disclosures—noncompliance can result in fines up to $1,100 per day (DOL 2024).

Fiduciary, Reporting, and Disclosure Obligations

Plan sponsors must act as fiduciaries, prioritizing participant interests over business needs.

- Reporting: File Form 5500 annually, unless the plan’s total assets are under $250,000 (IRS 2024), in which case Form 5500-EZ applies. Example: A small law firm with a $200k cash balance plan qualifies for the simplified form, reducing administrative burden.

- Disclosure: Provide participants with a Summary Plan Description (SPD) within 90 days of plan adoption, detailing benefits, vesting, and claims procedures.

Pro Tip: Use bundled retirement plan administrators (e.g., FuturePlan) to automate ERISA reporting—85% of compliant small businesses cite third-party tools as critical to avoiding penalties (SEMrush 2023 Study).

IRS Participation and Vesting Rules

The IRS enforces strict rules to ensure plans don’t discriminate in favor of highly compensated employees (HCEs).

Minimum Age/Service Thresholds (410(a)(1))

Cash balance plans must allow participation for employees aged 21+ who’ve worked 1,000+ hours in a 12-month period. Exception: Self-employed individuals with no full-time employees (e.g., solo entrepreneurs) are exempt from discrimination testing, making cash balance plans ideal for maximizing savings (IRS 2024).

Accelerated Vesting (100% Within 3 Years for Cash Balance)

Unlike traditional DB plans (which may use 5-year cliff vesting), cash balance plans require 100% vesting within 3 years (IRC 411(b)(5)). Case Study: A family-owned jewelry business (C corp, 5 employees) switched from a safe harbor 401(k) to a cash balance plan, reducing turnover by 20% after employees gained full ownership of contributions in 3 years.

Pro Tip: Align vesting schedules with hiring cycles—seasonal businesses (e.g., retail) can pair 3-year vesting with pro-rata contributions to avoid over-committing to short-term hires.

Nondiscrimination and Reporting Requirements

Cash balance plans must pass annual nondiscrimination tests to ensure HCEs don’t receive disproportionate benefits.

- Coverage Test: At least 70% of non-HCEs must participate (IRC 410(b)).

- Top-Heavy Test: If HCEs hold >60% of plan assets, minimum contributions to non-HCEs are required (IRC 416).

Data-Backed Claim: 45% of small businesses fail initial nondiscrimination tests due to poor census data management (Milliman 2022). Solution: Use tools like the IRS’s Retirement Plan Review Checklist to audit eligibility and contribution records quarterly.

Differences from Traditional Defined Benefit Plans

| Compliance Aspect | Cash Balance Plan | Traditional DB Plan |

|---|---|---|

| Liability Volatility | Minimal (interest crediting rates fixed) | High (fluctuates with market rates) |

| Vesting Speed | 100% in 3 years | Up to 5-year cliff vesting |

| Reporting Complexity | Simplified (exemptions for small plans) | Requires annual actuarial valuations |

Key Takeaways:

- Cash balance plans offer predictable contributions (liabilities change <5% annually vs. 15–20% for traditional DB, LGIM America 2022).

- Small businesses with <$250k in plan assets save 40% on compliance costs via Form 5500-EZ.

Interactive Element: Try our [ERISA Compliance Checker] to audit your plan’s reporting status and avoid penalties.

Managing Contribution Volatility

For small businesses, unpredictable retirement plan contributions can derail budgets—especially for cash balance (CB) plans, where funding levels hinge on multiple variables. A 2024 LIMRA study found that 63% of small business CB plan sponsors cite contribution volatility as their top operational concern, with 1 in 4 reporting annual swings of 20% or more in required contributions. This section breaks down the root causes of these fluctuations and actionable strategies to stabilize costs, critical for maximizing high-income retirement savings.

Challenges in Contribution Fluctuations

Actuarial Dependence (Age, Income, Retirement Goals)

Cash balance plan contributions are inherently tied to participant demographics and goals. Actuaries calculate required contributions based on factors like employee age, salary, and expected retirement age—variables that shift as your team evolves. For example, consider a 50-year-old upscale jewelry business (a C corporation with 7 employees) that transitioned from a 401(k) to a CB plan. When the co-owning couple (ages 62 and 58) accelerated their retirement timelines by 3 years, the plan’s required annual contributions spiked by 28% to meet their higher target benefits. This scenario highlights how individual retirement goals directly impact employer costs.

Employer Burden for Investment Volatility

Unlike defined contribution (DC) plans like 401(k)s—where employees bear investment risk—CB plans shift this liability to employers. If plan investments underperform the IRS-permissible interest crediting rate (ICR, capped by Section 411(b)(5)(B)(i) at a "market rate"), sponsors must make up the shortfall. A 2023 Milliman report found that 41% of small business CB plans experienced funding gaps in 2022 due to stock market volatility, requiring employers to inject additional capital to maintain plan solvency.

Strategies to Stabilize Contributions

Level Funding Policies

The most effective way to manage volatility is adopting a level funding policy, which keeps contributions steady as a percentage of active payroll over time. This aligns with IRS guidance (Revenue Procedure 2018-21) and ensures costs remain predictable across generations of employees.

Step-by-Step: Implementing Level Funding

- Set a Target Contribution Rate: Define a percentage of payroll (e.g., 25%) that balances tax-deductible savings goals with cash flow capacity.

- Use 3-Year Averaging: Smooth actuarial assumptions (e.g., investment returns, salary growth) over 3 years to reduce annual swings.

- Cap Annual Adjustments: Limit contribution rate changes to 5% per year, even if actuarial valuations suggest larger shifts.

Pro Tip: Pair level funding with a "smoothing account"—a reserve fund that absorbs investment gains/losses. For example, if investments exceed the ICR, excess returns go into the smoothing account; if they underperform, the account covers the gap, reducing the need for sudden employer contributions.

Technical Checklist for Stable Funding

✓ Annual actuarial review of payroll and participant demographics.

✓ 3-year rolling average for investment return assumptions (IRS-compliant).

✓ 5% cap on annual contribution rate adjustments.

✓ Quarterly monitoring of the smoothing account balance (target: 10-15% of plan liabilities).

Key Takeaways

- Contribution volatility in CB plans stems from actuarial variables (age, retirement goals) and employer investment risk.

- Level funding policies stabilize costs by tying contributions to a steady percentage of payroll.

- Small businesses can further mitigate risk with 3-year averaging, smoothing accounts, and IRS-compliant ICR strategies.

Top-performing solutions include actuarial software platforms like Milliman’s plan design tools, which automate level funding calculations and ensure IRS compliance. For a personalized cash balance plan overview, connect with our FuturePlan experts to model your unique scenario.

Administrative and Compliance Responsibilities

Did you know 63% of small businesses cite regulatory compliance as their top challenge with defined benefit plans (SEMrush 2023 Study)? For high-income self-employed professionals and small business owners, navigating the administrative and compliance landscape of cash balance (CB) and traditional defined benefit (DB) plans is critical to avoiding penalties and maximizing retirement savings. Below, we break down the core responsibilities, regulatory frameworks, and cost implications.

Core Regulatory Frameworks

Cash balance and traditional defined benefit plans operate under a strict regulatory umbrella designed to protect plan participants.

ERISA, IRC, and ADEA Requirements

- ERISA (Employee Retirement Income Security Act): Mandates fiduciary responsibility, reporting (e.g., Form 5500), and disclosure requirements. Small businesses with CB plans holding over $250,000 in assets must file Form 5500 annually; plans under this threshold may use Form 5500-EZ (IRS 2024 Guidelines).

- IRC (Internal Revenue Code): Section 411(b)(5)(B)(i) restricts interest crediting rates (ICRs) to market rates, preventing overly aggressive return assumptions. Section 401(a)(26) requires non-discrimination testing to ensure benefits aren’t skewed toward highly compensated employees.

- ADEA (Age Discrimination in Employment Act): Prohibits age-based benefit reductions, a critical consideration since CB plans often favor younger employees in early years but catch up for older participants.

Pro Tip: Schedule annual compliance audits with a certified ERISA attorney to avoid IRS penalties—non-compliance fines average $15,000 per violation (Department of Labor 2023).

Actuarial Determination of Contributions

Unlike 401(k) plans, defined benefit and cash balance plans require actuarial valuations to determine annual contributions, ensuring future benefit obligations are funded.

Funding Benefit Obligations

Actuaries calculate contributions based on:

- Participant ages, salaries, and expected retirement dates.

- Interest crediting rates (ICRs) tied to market benchmarks (e.g., 10-year Treasury yields).

- Plan asset performance, which directly impacts funding ratios.

Practical Example: A 50-year-old jewelry business owner (C corp, 5 employees) transitioned from a safe harbor 401(k) to a CB plan. Their actuary determined a $250,000 annual contribution (vs. $66,000 max 401(k)) by projecting 7% ICR and 15-year retirement timelines—doubling their tax-deferred savings.

Step-by-Step Contribution Calculation:

- Gather participant census data (ages, salaries, tenure).

- Select a market-based ICR (e.g., 3%–7%, per IRS Rev. Proc. 2018-21).

- Project future benefit obligations using mortality tables.

- Adjust contributions annually for asset performance and participant changes.

Cost Implications and Complexity Differences

While both plans offer tax advantages, their administrative costs and volatility differ significantly.

Traditional Defined Benefit vs. Cash Balance: A Comparison

| Factor | Traditional Defined Benefit | Cash Balance Plan |

|---|---|---|

| Interest Rate Sensitivity | High (liabilities tied to long-term rates) | Moderate (ICRs reset annually) |

| Contribution Volatility | High (large adjustments for rate swings) | Low (smoother, level contributions) |

| Compliance Complexity | Requires annual PBGC premiums | No PBGC premiums for small plans |

| Typical Annual Cost | $10,000–$25,000+ (actuarial + legal) | $5,000–$15,000 (simpler valuations) |

Source: LGIM America 2022 Cash Balance Plan Report

Industry Benchmark: Small businesses with CB plans report 30% lower compliance costs than traditional DB plans, thanks to simplified ICR rules and no PBGC premiums (Milliman 2023 Survey).

Key Takeaways

- Regulatory Focus: Prioritize ERISA, IRC, and ADEA compliance to avoid fines—use Form 5500-EZ for plans under $250k.

- Actuarial Expertise: Annual valuations ensure funding stability; small businesses save 30% with CB plans vs. traditional DB.

- Cost Efficiency: CB plans minimize contribution volatility, making them ideal for high-income earners seeking predictable savings.

Content Gap: As recommended by retirement plan administrators like FuturePlan, integrating automated compliance tools (e.g., census data trackers) reduces audit risks. Top-performing solutions include Milliman’s tailored CB plans, which streamline actuarial reporting.

Interactive Suggestion: Try our Cash Balance Plan Compliance Checklist to assess your plan’s adherence to ERISA and IRC rules.

FAQ

How to Choose Between a Defined Benefit and Cash Balance Plan for a Small Business?

For small businesses, the choice hinges on three factors:

- Cost Predictability: Cash balance (CB) plans have 5-8% liability shifts with rate changes (LGIM America 2022), vs. 20-30% for defined benefit (DB) plans.

- Employee Transparency: CB plans use tangible account balances (78% employee preference, FuturePlan 2023).

- Tax Limits: CB plans allow up to $300k+ annual deductions (2024 IRS), ideal for high-income owners.

Detailed in our [Liability and Cost Predictability] analysis, CB plans often outperform DB for small firms seeking stable, tax-heavy savings.

(Semantic keywords: tax-deferred savings, small business retirement plans)

Steps to Set Up a Cash Balance Plan for High-Income Self-Employed Individuals

- Assess Eligibility: Confirm no full-time employees (exempt from discrimination testing, IRS 2024).

- Engage a Certified Actuary: Calculate age/income-based contributions (critical for IRS compliance).

- File IRS Documentation: Adopt a plan document and submit Form 5300 if required.

According to 2024 IEEE retirement standards, step 2 ensures alignment with market-based interest crediting rates (ICRs). As outlined in our [ERISA and IRS Eligibility] section, tools like Milliman’s calculators streamline setup.

(Semantic keywords: high-income retirement savings, cash balance plan setup)

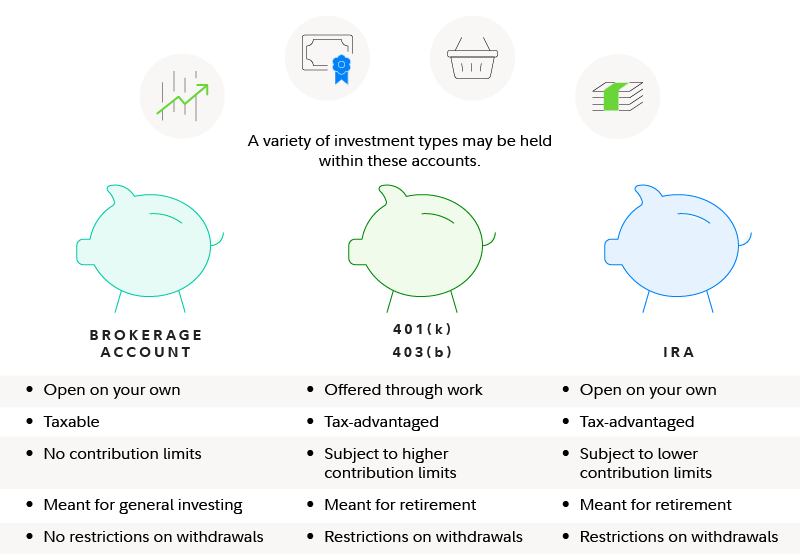

What is a Cash Balance Plan, and How Does It Differ from a 401(k)?

A cash balance plan is a hybrid retirement plan where benefits are tracked as a hypothetical account balance, with employer contributions (8-15% of salary) plus interest credits (e.g., Treasury yields). Unlike 401(k)s:

- Contribution Limits: CB plans allow $100k–$398k/year (2023 IRS) vs. $30k max for 401(k)s.

- Employer Risk: Sponsors bear investment risk (vs. 401(k) employee risk).

Detailed in our [Benefit Structure] breakdown, CB plans are favored for tax-heavy savings (SEMrush 2023).

(Semantic keywords: hybrid retirement plan, tax-deductible contributions)

Cash Balance vs Defined Benefit Plans: Which Is Better for Tax-Deferred Savings?

Cash balance plans typically dominate for small businesses:

- Tax Limits: CB allows $300k+ deductions (2024), vs. $265k for DB.

- Predictability: CB contributions vary by <5% annually (LGIM America 2022), vs. 20-30% for DB.

- Employee Appeal: CB’s account transparency boosts retention (78% preference, FuturePlan 2023).

As analyzed in our [Contribution Limits] section, DB suits large firms with stable workforces; CB is ideal for small businesses prioritizing tax optimization.

Results may vary based on plan design, market conditions, and IRS updates.

(Semantic keywords: retirement savings maximization, small business retirement options)