Self-employed professionals can maximize 2024 retirement savings with IRS-approved strategies: Defined Benefit Plans, Mega Backdoor […]

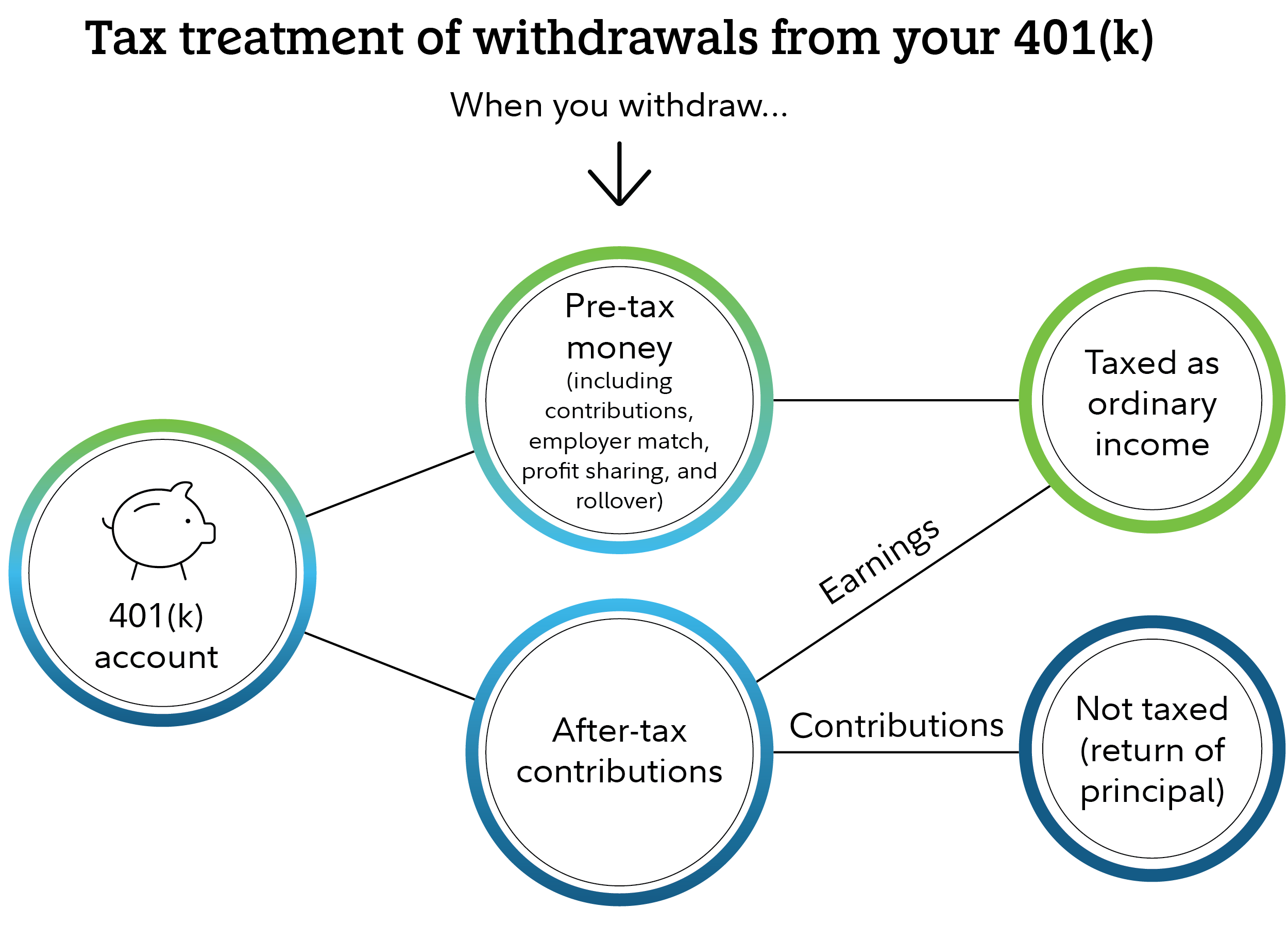

Roth Conversion Ladder, After-Tax 401(k) Contributions & HSA: A Complete Strategic Guide to Retirement Savings

67% of early retirees cite "tax inefficiency" as their top regret (Fidelity 2023)—fix this with […]

2024 Expert Guide: Backdoor Roth IRA Pro-Rata Rule, Cash Balance Pension Plans & In-Service Rollover Rules – Tax Strategies & SECURE 2.0 Updates

60% of backdoor Roth IRA conversions fail due to the pro-rata rule, warns the 2024 […]

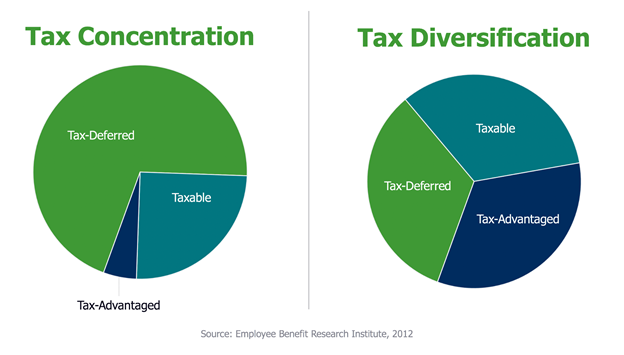

Tax Loss Harvesting & Asset Location: Expert Strategies to Optimize Investments Across Taxable, Tax-Deferred, and Tax-Exempt Accounts

Want to slash taxes and supercharge your portfolio? Tax loss harvesting (TLH) and asset location […]

529 Plan vs Retirement Savings: SECURE 2.0 Roth IRA Conversion Rules, Tax Benefits & Advanced Strategies – Expert Guide

Struggling to balance college savings and retirement? Don’t risk raiding 401(k)s—33% of parents do, delaying […]

Ultimate Guide to HSA Eligibility, Maximizing Annual Contributions, and HDHP Strategies for Tax Savings & Retirement Planning

Boost your 2024 tax savings and retirement nest egg with the ultimate HSA guide—now updated […]