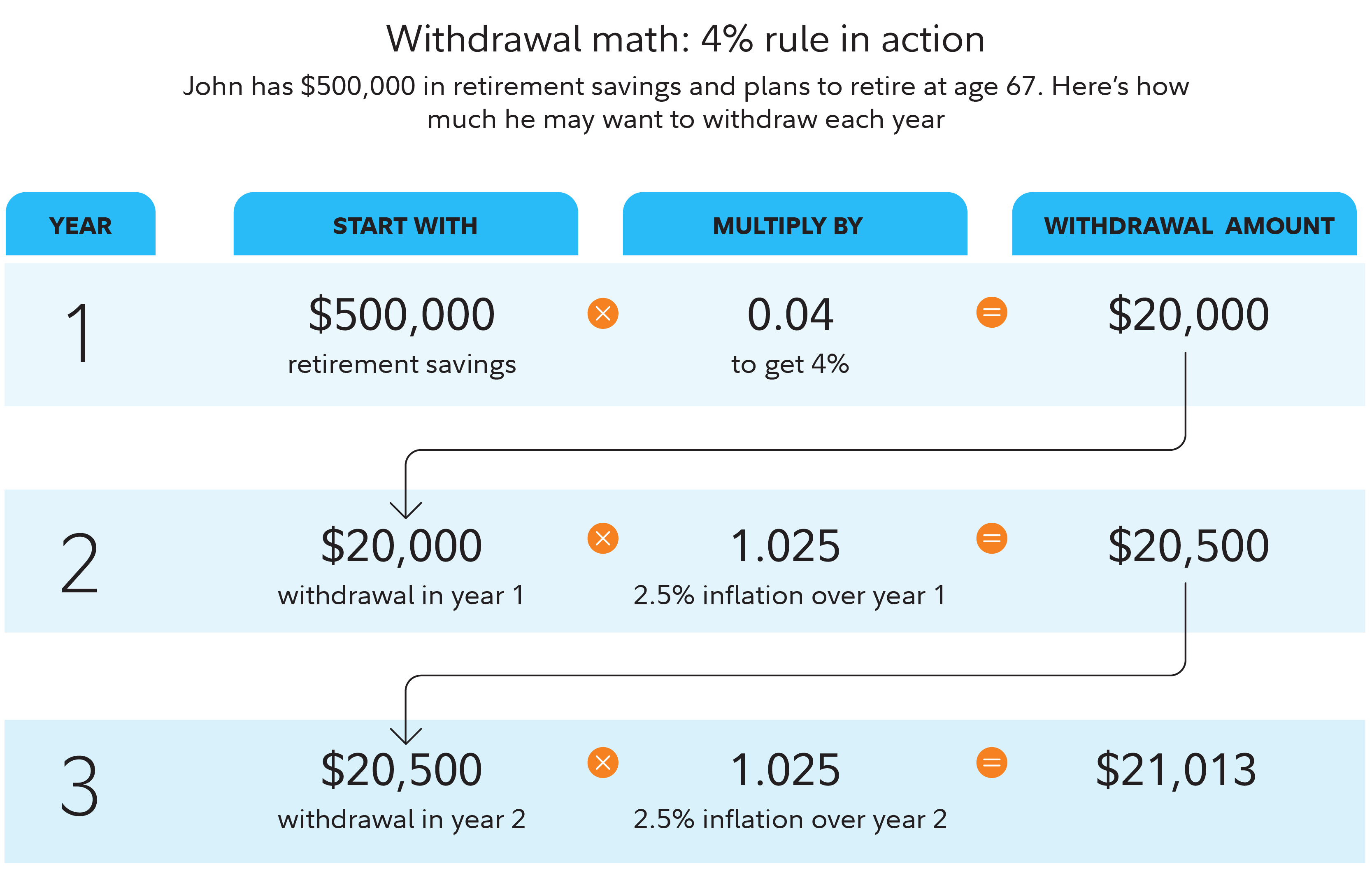

Retirees, don’t let taxes or bad market timing shrink your savings—here’s how to boost portfolio […]

Expert Guide to Required Minimum Distributions (RMDs) 2024: Tax-Saving Strategies Including QCDs, Roth Conversions, and IRS Compliance

Need to master 2024 Required Minimum Distributions (RMDs) while cutting taxes? New IRS rules (SECURE […]

Ultimate HSA Investment Guide: Comparing Top Options, Low-Fee Platforms, & Rollover Strategies for Maximum Returns

Looking to supercharge your HSA’s tax-free growth in 2024? This urgent buying guide compares top […]

Maximizing ESPP Benefits: Expert Tax Strategies for Selling Shares & Optimizing Returns

Did you know 68% of U.S. employees with ESPPs leave $3,200 in annual discounts unclaimed? […]

2024 Solo 401k Guide for Freelancers & Consultants: Setup, Best Providers, and Maximizing Contributions

:max_bytes(150000):strip_icc()/financial_plan_final-e8e690fce7c7406fb4cc607e408681df.png) Freelancers and consultants—boost 2024 retirement savings with a Solo 401k, letting you stash up […]

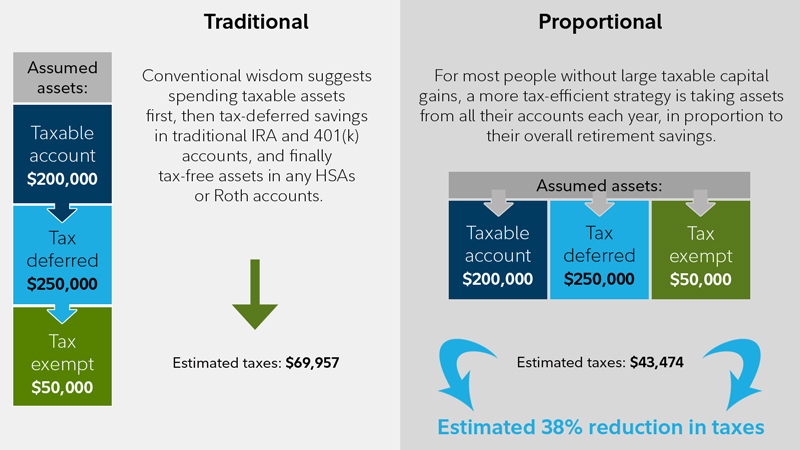

Expert Guide to Roth vs. Traditional Retirement Accounts: Tax Diversification Strategies to Minimize Retirement Income Taxes

Struggling to choose between Roth and Traditional retirement accounts? Don’t risk losing up to 30% […]