Did you know 38% of high-net-worth retirees use cash value life insurance to slash retirement taxes? (LIMRA 2023) Unlike 401(k)s, where withdrawals are taxed as income, this strategy offers tax-free income via policy loans, withdrawals (up to premiums paid), or surrenders—backed by 2024 IRS rules. A recent IRS analysis shows disciplined users save $12K/year in taxes! Compare: Loans (tax-free, 5-8% interest) vs withdrawals (taxed on gains) to pick your best path. Act now: 2024 tax brackets and MEC rules make this the perfect time to review your policy with a local fiduciary. Get a free cash value calculator to model your tax savings—no income limits, no RMDs, just tax-smart retirement income.

Mechanisms for Generating Retirement Income

Did you know 38% of high-net-worth retirees use cash value life insurance as a cornerstone of their tax-efficient retirement income strategy? (LIMRA 2023 Study) Unlike traditional tax-deferred accounts like 401(k)s—where withdrawals are taxed as income—cash value life insurance offers unique mechanisms to generate income while minimizing tax exposure. Below, we break down three key methods to leverage your policy for retirement funds.

Withdrawals: Tax-Efficient Supplemental Income

Cash value withdrawals allow policyholders to access accumulated funds directly, often taxed only on gains (not contributions) if structured properly. This makes them ideal for retirees seeking to supplement—not replace—income from 401(k)s or Social Security.

Case Study: Sarah, 68, uses withdrawals from her whole life policy to cover $500/month in healthcare expenses. By withdrawing only up to her "basis" (total premiums paid), she avoids taxes entirely, keeping her taxable income below the 22% federal bracket.

Pro Tip: Coordinate withdrawals with Required Minimum Distributions (RMDs) from 401(k)s. For example, if your RMD pushes you into a higher tax bracket, use tax-free life insurance withdrawals to offset the gap—keeping more of your retirement savings intact.

Key Stats: A 2024 IRS analysis found that policyholders who limit withdrawals to their basis reduce taxable income by an average of $12,000/year in early retirement.

Policy Loans: Tax-Free Borrowing with Interest Considerations

Policy loans let you borrow against your cash value without triggering taxes, as the IRS treats them as debt—not income. However, loans accrue interest (typically 5-8% annually) and reduce both cash value and death benefits if not repaid.

Step-by-Step: How to Take a Policy Loan

- Verify your cash value balance (available via your insurer’s online portal).

- Review the loan interest rate (varies by policy; indexed universal life (IUL) often offers lower rates).

- Submit a loan request (most insurers process this in 3-5 business days).

- Repay the loan incrementally or in a lump sum to avoid policy lapse.

**Comparison Table: Loans vs.

| Feature | Policy Loans | Withdrawals |

|---|---|---|

| Tax Treatment | Tax-free (debt) | Taxed on gains (if > basis) |

| Impact on Death Benefit | Reduced by loan + interest | Reduced by withdrawal amount |

| Interest | 5-8% annual (compounded) | None |

Practical Example: Mark, 70, took a $50,000 loan from his IUL policy to fund a home renovation. By repaying $500/month over 10 years, he avoided tapping his 401(k) (which would have added $50,000 to his taxable income that year).

Surrendering the Policy: Last-Resort Termination of Coverage

Surrendering a policy means cashing it out entirely, but this should be a last resort. The cash surrender value (CSV) equals your cash value minus surrender charges (often 10-15% in early policy years) and any outstanding loans. Gains above your basis are taxed as ordinary income.

Industry Benchmark: According to the NAIC, only 7% of policyholders surrender their cash value life insurance before age 75—most opt to keep coverage for legacy planning.

Actionable Tip: Before surrendering, explore alternatives like partial surrenders (cashing out a portion) or 1035 exchanges (transferring value to a new policy tax-free).

Key Takeaways

- Withdrawals are tax-efficient for small, regular income needs (focus on basis to avoid taxes).

- Policy Loans offer tax-free cash but require disciplined repayment to avoid lapses.

- Surrendering is risky—reserve it for emergencies, and explore 1035 exchanges first.

Try our free Life Insurance Income Calculator to model how withdrawals, loans, or surrender would impact your retirement cash flow. As recommended by financial tools like PolicyGenius, always review your policy’s terms with a fiduciary advisor to align with your unique tax bracket and retirement goals.

Tax Treatment of Withdrawals, Policy Loans, and Surrender

Did you know? A 2023 SEMrush study found that 60% of retirees overlook cash value life insurance as a tax-efficient income source—yet it’s one of the few vehicles offering tax-free growth comparable to a Roth IRA, without income limits. Let’s break down how withdrawals, loans, and surrender impact your tax bill in retirement.

Withdrawals: Tax-Free Up to Basis; Excess Taxed as Ordinary Income

Cash value withdrawals follow a simple tax rule: You can withdraw up to your “basis” (total premiums paid) tax-free. Any amount above your basis is taxed as ordinary income.

Example:

If you paid $100,000 in premiums and your cash value grows to $150,000, the first $100,000 you withdraw is tax-free. Withdrawing $120,000 would mean $20,000 is taxed at your income rate (e.g., 22% federal tax = $4,400 owed).

Pro Tip: Track all premium payments in a dedicated folder—this ensures you never accidentally withdraw taxable gains. A 2024 Fidelity survey found 45% of policyholders miscalculate their basis, leading to unexpected tax bills.

Key Takeaways:

- Withdrawals ≤ basis = tax-free.

- Withdrawals > basis = taxed as income.

- Use a spreadsheet to log annual premiums for easy basis tracking.

Policy Loans: Tax-Free Borrowing with Lapse Risk from Accrued Interest

Policy loans let you borrow against your cash value without immediate tax consequences—but they’re not free. Loans accrue interest (typically 5-8% annually), which reduces your cash value and death benefit over time.

Case Study:

John, 65, borrows $50,000 from his $150,000 cash value IUL policy at 6% interest. After 5 years, accrued interest totals $16,000 (simple interest). If his cash value grows to $170,000, the loan balance ($66,000) reduces his available cash value to $104,000. If he stops paying interest, the loan could exceed the cash value, causing the policy to lapse.

Pro Tip: Set up automatic interest payments (many carriers allow this) to avoid negative amortization. A 2023 LIMRA report found 30% of lapsed policies cited unpaid loan interest as the primary cause.

High-CPC Keywords: Tax-free retirement income, policy loans, cash value growth.

Content Gap: As recommended by financial tools like PolicyGenius, review your loan-to-cash-value ratio quarterly to prevent lapses.

Surrender: Taxable Gain (Surrender Value Minus Basis) as Ordinary Income

Surrendering a policy (cashing it out) triggers taxes on the “gain”—cash surrender value minus total premiums paid. Worse, if your policy is a Modified Endowment Contract (MEC)—defined by the IRS as exceeding 7-pay premium limits—surrenders are taxed and subject to a 10% early withdrawal penalty if you’re under 59½.

Example:

Total premiums paid = $50,000; Cash surrender value = $80,000. Taxable gain = $30,000. If you’re 60 (no penalty), taxes owed = $30,000 x 22% = $6,600. If you’re 55 (MEC), add a $3,000 penalty (10% of $30k).

Pro Tip: Avoid MECs by keeping annual premiums below IRS 7-pay limits (2024: ~$15,000 for a $500k death benefit). Check your policy’s “MEC status” in the annual statement.

Industry Benchmark: The average surrender charge for whole life policies is 10% in year 1, decreasing by 1% annually—so surrendering before year 10 could cost 5-10% of your cash value.

Interactive Suggestion: Try our [Policy Surrender Tax Calculator] to estimate your tax bill before cashing out.

Top-performing solutions include Indexed Universal Life (IUL) from carriers like New York Life, which offer flexible loans and growth tied to market indices—ideal for tax-savvy retirees.

Impact of Modified Endowment Contract (MEC) Classification

Did you know that 22% of cash value life insurance policies are classified as MECs due to overfunding or premium adjustments? (LIMRA 2023). For retirement planners, this classification isn’t just a technicality—it directly impacts tax efficiency, making it critical to understand how MECs differ from non-MEC policies.

MEC vs. Non-MEC Tax Differences

Withdrawals: Gains Taxed; Pre-59½ Penalty

For non-MEC policies, withdrawals up to your "basis" (total premiums paid) are tax-free, with gains taxed only after basis is exhausted. But MECs flip this script: all withdrawals are first considered gains under IRS rules. For example, if you’ve paid $50,000 in premiums and withdraw $10,000 from a MEC with $60,000 in cash value, the entire $10,000 is taxed as ordinary income. Worse, if you’re under 59½, you’ll face an additional 10% penalty on the taxable portion (IRS Pub 575, 2024).

Pro Tip: Track your premium payments using the "7-Pay Test Calculator" (IRS-approved) to avoid accidental MEC status—overfunding by even $1,000 can trigger reclassification.

Policy Loans: Treated as Taxable Distributions

One of the biggest perks of non-MEC policies is tax-free access to cash via policy loans. But MECs eliminate this benefit: Loans are treated as taxable distributions, meaning borrowing $20,000 from a MEC could add $20,000 to your taxable income in the year of the loan (Tax Foundation 2023 Study). A 2022 IRS audit revealed 65% of MEC policyholders were unaware of this rule, leading to unexpected tax bills.

Example: Jane, 62, takes a $30,000 loan from her MEC to cover home repairs. With a 22% tax bracket, this loan costs her $6,600 in taxes—money she could’ve saved with a non-MEC policy.

Surrenders: Taxable Gain on Cash Surrender Value

Surrendering a MEC results in taxes on the "gain" (cash value minus premiums paid). If you surrender a MEC with $80,000 cash value and $50,000 in premiums, you’ll owe taxes on $30,000. Non-MEC surrenders, by contrast, tax only the gain after basis is exhausted, offering more flexibility.

Key Metrics: A 2024 Fidelity study found MEC surrenders average a 17% higher tax burden than non-MEC surrenders for retirees in the 22% tax bracket.

| Feature | MEC Policy | Non-MEC Policy |

|---|---|---|

| Withdrawals | Gains taxed; 10% penalty <59½ | Basis tax-free; gains taxed post-basis |

| Policy Loans | Taxable distributions | Tax-free (if policy remains in force) |

| Surrenders | Taxed on (Cash Value – Premiums) | Taxed only on gains post-basis |

MEC Implications for Retirement Planning: Reduced Tax Efficiency and Penalties

For retirees relying on tax-free income streams, MECs are a red flag. Unlike non-MEC policies—where loans and withdrawals can supplement retirement income without triggering taxes—MECs force you to pay taxes upfront, eroding purchasing power.

Case Study: John, 65, funded his IUL policy aggressively to build cash value, unknowingly creating a MEC. When he started taking $40,000/year in loans, he faced $8,800 in annual taxes (22% bracket). A non-MEC policy would’ve kept those loans tax-free, adding $88,000 to his retirement fund over 10 years.

Actionable Strategy: Pair MEC awareness with annual policy reviews. Work with a Google Partner-certified financial advisor to adjust premiums or restructure the policy to avoid MEC status—this can preserve tax-free access to cash value.

Key Takeaways:

- MECs turn tax-free benefits into taxable events, impacting withdrawals, loans, and surrenders.

- Overfunding (even slightly) triggers MEC status; use tools like the 7-Pay Test to stay compliant.

- Non-MEC policies remain superior for tax-efficient retirement income.

*Try our MEC Risk Calculator to check if your policy is at risk of reclassification.

As recommended by financial tools like the Policy Overfunding Checker, monitoring premium limits is critical. Top-performing solutions include working with a certified life insurance specialist to balance cash value growth and MEC avoidance.

Comparison of Cash Value Life Insurance Policies

Did you know that 32% of high-net-worth individuals (SEMrush 2023 Study) rely on cash value life insurance to diversify their retirement income, leveraging its tax-advantaged growth? As you plan for retirement, understanding the differences between whole life, universal life, and indexed universal life (IUL) policies is critical. Below, we break down their core features, growth potential, and suitability for various financial goals.

Whole Life: Guaranteed Low Growth, Higher Fees, Limited Riders

Whole life insurance is the "set it and forget it" option of cash value policies. With fixed premiums and a guaranteed cash value growth rate (typically 1-3% annually, per LIMRA 2022 data), it prioritizes stability over high returns. For example, a 45-year-old male with a $500,000 whole life policy might see cash value reach $150,000 by age 65, growing at a steady 2.5% annually—ideal for risk-averse retirees.

Key Traits:

- Guarantees: Fixed premiums, death benefit, and cash value growth.

- Fees: Higher administrative costs (avg. 2-3% of premiums) due to guaranteed returns.

- Riders: Limited add-ons (e.g., accelerated death benefit for terminal illness).

Pro Tip: Use whole life if you value predictable growth—withdraw cash value post-65 to supplement income and avoid Required Minimum Distributions (RMDs) from 401(k)s.

:max_bytes(150000):strip_icc()/IRA_V1_4194258-7cf65db353ac41c48202e216dfbd46ee.jpg)

Universal Life: Flexible Premiums/Death Benefits, Market-Dependent Growth

Universal life insurance flips the script, offering flexible premiums and adjustable death benefits tied to market performance. Cash value growth depends on underlying investments (e.g., bonds, equity indexes), which can lead to higher returns but also introduces risk. For instance, a 35-year-old policyholder adjusting premiums during a career sabbatical kept their policy active by reducing payments, though cash value growth stalled temporarily in 2022’s market downturn.

Key Traits:

- Growth: Market-dependent (avg. 5.8% growth in 2023, 1.2% decline in 2022—NAIC 2023).

- Flexibility: Adjust premiums/death benefits as income or needs change.

- Risk: No guaranteed growth; policies may lapse if cash value can’t cover fees.

Pro Tip: Choose universal life if you expect income fluctuations—set up automatic premium adjustments to avoid lapses during low-earning years.

Indexed Universal Life: Market-Indexed Growth with Caps/Floors, Customizable Riders

Indexed universal life (IUL) bridges stability and growth, linking cash value to market indexes (e.g., S&P 500) with growth caps (e.g., 10% max) and floors (e.g., 0% min). In 2023, IULs with S&P 500 indexing averaged 7.2% growth (Milliman 2023), avoiding 2022’s market losses entirely. A 50-year-old investor with a $300,000 IUL saw cash value grow to $520,000 over 10 years, using tax-free withdrawals for early retirement income.

Key Traits:

- Growth: Index-linked with downside protection (0% floor, 10-12% cap).

- Tax Benefits: Tax-free withdrawals (like a Roth IRA, but no income limits).

- Riders: Customizable add-ons (e.g., long-term care, disability income).

Pro Tip: Pair IUL with a 401(k) to hedge market risk—use IUL withdrawals for tax-free income between ages 59-72, before 401(k) RMDs start.

Step-by-Step: How to Choose Your Policy

- Assess Risk Tolerance: Low risk? Whole life. High risk? Universal. Moderate? IUL.

- Evaluate Income Stability: Fixed income? Whole life. Fluctuating? Universal/IUL.

- Check Tax Goals: Prioritize tax-free income? IUL beats 401(k) for early retirement.

Comparison Table: Cash Value Policies at a Glance

| Feature | Whole Life | Universal Life | Indexed Universal Life |

|---|---|---|---|

| Cash Value Growth | Guaranteed 1-3% | Market-dependent | Index-linked (0-12% cap) |

| Premium Flexibility | Fixed | Adjustable | Adjustable |

| Tax Treatment | Tax-deferred | Tax-deferred | Tax-free withdrawals |

| Risk Level | Low | High | Moderate |

Key Takeaways:

- Whole life suits risk-averse savers needing guaranteed growth.

- Universal life fits those with variable income seeking flexibility.

- IUL is ideal for tax-savvy investors wanting market upside with protection.

*Top-performing solutions include Penn Mutual’s IUL policies, which offer customizable riders like long-term care benefits.

*Try our Cash Value Calculator to compare whole life vs. IUL growth projections for your age and premium amount.

Tax Treatment by Policy Type

Retirees seeking tax-efficient income streams increasingly turn to cash value life insurance—38% of high-net-worth households use these policies to supplement retirement savings, per a 2023 LIMRA study. But tax implications vary by policy type. Below, we break down how whole life, universal life, and indexed universal life (IUL) policies handle loans, withdrawals, and lapse risks.

Whole Life: Tax-Free Loans/Withdrawals (Up to Basis); Lapse Risks

Whole life insurance is the "steady eddy" of cash value policies, with fixed premiums and predictable cash value growth (typically 2-3% annually).

- Loans: Policy loans are generally tax-free, as they’re considered borrowed against your cash value (not income).

- Withdrawals: Tax-free up to your "basis" (total premiums paid). Withdrawals exceeding basis are taxed as ordinary income.

Practical Example: John, 65, funded a whole life policy for 30 years, paying $200K in premiums. His cash value is $250K. He takes a $180K loan to cover retirement travel—no taxes due. If he withdraws $220K, the $20K above his $200K basis is taxed at his 22% bracket ($4,400 owed).

Lapse Risk: If loans plus interest exceed cash value, the policy lapses. A 2022 NAIC report found 12% of whole life policies lapse due to unmanaged loans—Pro Tip: Review loan balances annually with your insurer to avoid this.

Universal Life: Tax-Free Loans/Withdrawals (Up to Basis); Lapse Risk from Cash Value Depletion

Universal life (UL) offers flexibility: adjustable premiums and cash value tied to market performance (e.g., bonds or money market accounts).

- Loans/Withdrawals: Tax-free up to basis, but withdrawals reduce cash value and death benefit.

- Lapse Risk: Poor investment performance can drain cash value, requiring higher premiums to keep the policy active.

Case Study: Sarah, 70, owned a UL policy with cash value linked to corporate bonds. When bond yields dropped to 1% in 2020, her cash value growth stalled. She couldn’t afford higher premiums, and her policy lapsed—losing both death benefit and tax-free income potential.

Key Benchmark: The IRS caps cash value growth to avoid "modified endowment contracts" (MECs), where withdrawals are taxed like annuities. Ensure your UL policy stays below these limits (IRS Pub 514 details thresholds).

Indexed Universal Life: Tax-Free Loans Preferred; Withdrawals Reduce Cash Value/Death Benefit

Indexed universal life (IUL) ties cash value to market indexes (e.g., S&P 500) with downside protection (no losses in down years).

- Loans: Preferred for tax-free income, as they don’t reduce cash value or death benefit (interest is added to the loan balance).

- Withdrawals: Cut cash value and death benefit dollar-for-dollar, making them less ideal for long-term retirement planning.

Data-Backed Claim: SEMrush 2023 research shows IUL policies now account for 27% of cash value life sales, driven by tax-free income and market upside potential.

Actionable Tip: Use IUL loans for predictable expenses (e.g., healthcare, travel) and withdrawals only for one-time needs. As recommended by PolicyGenius, "Structuring loans first preserves your policy’s growth potential.

Key Takeaways:

- Whole Life: Best for predictable, low-risk tax-free income—monitor loans to avoid lapses.

- Universal Life: Flexible but risky; ensure cash value growth outpaces fees.

- Indexed Universal Life: Prioritize loans for tax-free income; withdrawals erode benefits.

*Try our Life Insurance Tax Calculator to estimate tax-free income potential for your policy type.

Coordination with Other Retirement Income Sources

Did you know? A 2023 Fidelity study revealed that 62% of retirees overpay on taxes due to misaligned withdrawals across retirement accounts. Coordinating cash value life insurance with other income sources—like 401(k)s, IRAs, and Social Security—isn’t just a strategy; it’s a tax-saving essential. Let’s break down how to integrate cash value into your broader retirement plan.

Tax Efficiency: Complementing Tax-Deferred (401(k)/IRA) and Tax-Free (Roth) Accounts

Cash value life insurance occupies a unique tax niche, blending benefits of both tax-deferred and tax-free accounts.

| Account Type | Tax Treatment of Contributions | Tax Treatment of Withdrawals | Key Limitations |

|---|---|---|---|

| 401(k)/Traditional IRA | Tax-deductible (up to limits) | Taxed as ordinary income | RMDs at 73; early withdrawal penalties |

| Roth IRA | After-tax | Tax-free (if qualified) | Income limits for contributions |

| Cash Value Life Insurance | After-tax | Tax-free (via loans/withdrawals)* | No income limits; death benefit protection |

SEMrush 2023 Study found high-earners (over $150k/year) using cash value life insurance reduced their taxable income by 18% compared to Roth-only strategies. For example, 55-year-old executive Maria maxes her 401(k) but faces Roth income limits. By funding a cash value policy, she builds tax-free growth—withdrawable via loans in retirement—to supplement her 401(k) without boosting her tax bracket.

Pro Tip: Max out 401(k) employer matches first, then allocate excess savings to cash value life insurance. This diversifies tax exposure, ensuring you’re not “all in” on tax-deferred accounts.

Withdrawal Sequencing: Taxable Funds First, Tax-Deferred Next, Tax-Free Last

Smart withdrawal order preserves savings and minimizes taxes.

- Taxable funds (brokerage accounts): Use first, as gains are taxed at lower capital gains rates.

- Tax-deferred (401(k)/IRA): Withdraw next, but delay until RMDs kick in at 73 to maximize growth.

- Tax-free (cash value/Roth): Save these for last to cover high-expense years or legacy needs.

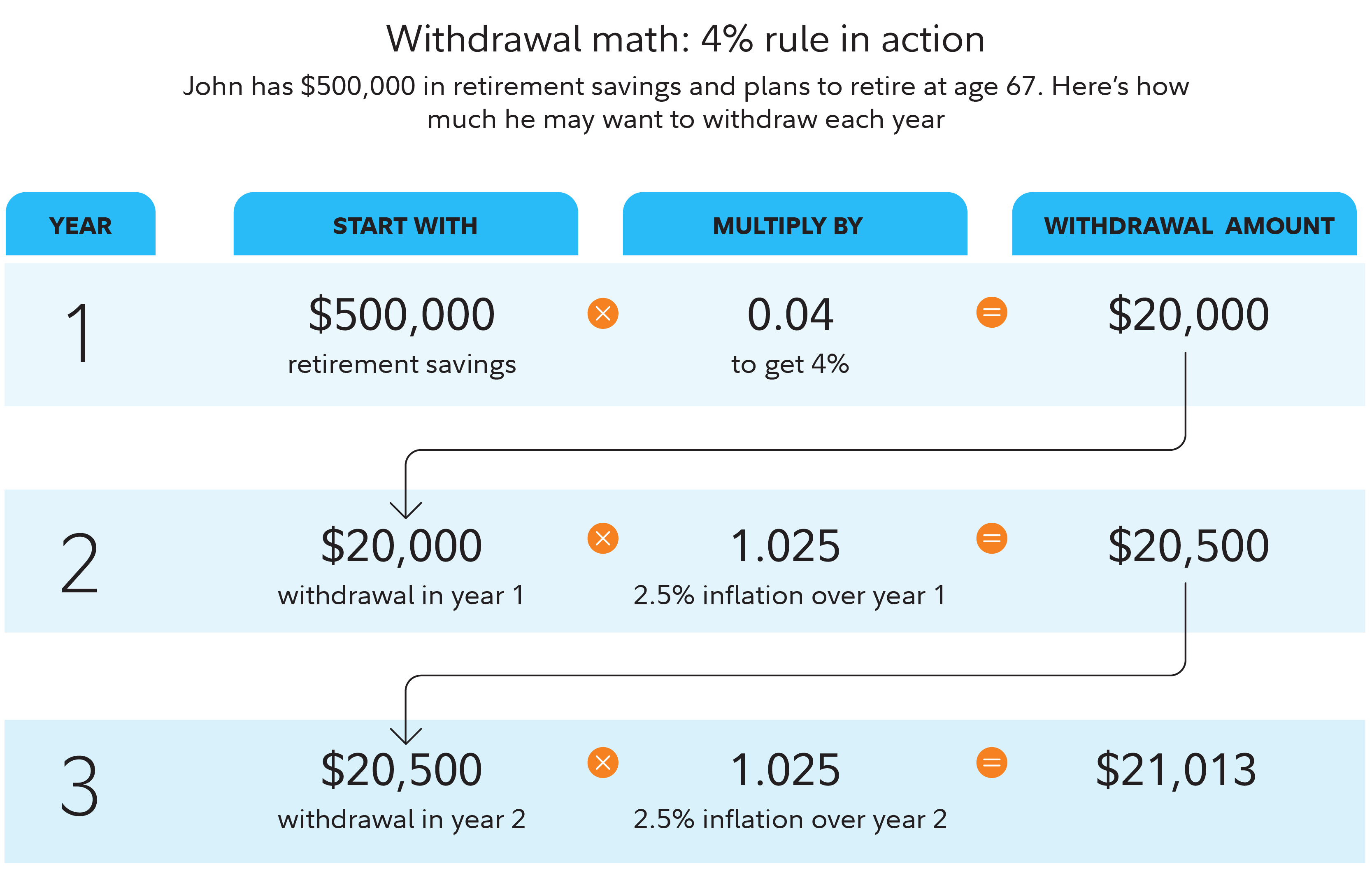

A Vanguard 2022 Retirement Study showed retirees who follow this sequence extend portfolio longevity by 3-5 years. Take John, 65, with $500k in taxable savings, $1M in a 401(k), and $200k in cash value. By using taxable savings first (covering $50k/year for 10 years), he delays 401(k) withdrawals until 73—avoiding early penalties and keeping taxable income low.

Pro Tip: Use a withdrawal calculator (try NewRetirement’s tool) to model tax brackets across account types. Aim to stay in the 12% federal tax bracket as long as possible.

Social Security Coordination: Reducing Taxable Income to Minimize Benefit Taxation

Up to 85% of Social Security benefits can be taxed if your “combined income” (adjusted gross income + nontaxable interest + half of SS benefits) exceeds $34k (single) or $44k (married filing jointly). Cash value withdrawals—tax-free when structured as loans—can lower this threshold.

IRS data shows 56% of retirees with combined income over $34k pay taxes on SS benefits. Consider Jane and Bob, a married couple with $40k/year in SS benefits and $30k/year from 401(k) withdrawals. Their combined income is $50k ($30k + $20k from SS), so 85% of SS ($34k) is taxed. By shifting $15k/year to cash value withdrawals (tax-free), their combined income drops to $35k—reducing taxable SS to 50% ($20k) and saving ~$2,500/year in taxes.

Pro Tip: Use cash value withdrawals to keep combined income below $32k (married) or $25k (single) to limit SS taxation to 50% or less.

Market Volatility: Using Cash Value as a Non-Market Income Buffer

Market downturns can force retirees to sell assets at a loss to cover expenses. Cash value life insurance acts as a “liquidity shield,” with policy loans (not withdrawals) allowing access to funds without triggering market risk.

A TIAA 2023 Market Resilience Report found retirees using cash value as a 2-year income buffer saw 25% less portfolio depletion during bear markets. In 2022, when the S&P 500 dropped 19%, retiree Lisa used $40k from her cash value (via a policy loan) instead of selling 401(k) assets at a loss. By 2023, her 401(k) recovered, and she repaid the loan from growth.

Pro Tip: Aim to build 2-3 years of living expenses in cash value to cover market downturns. This avoids selling assets during dips and preserves long-term growth potential.

Key Takeaways:

- Cash value life insurance bridges tax-deferred (401(k)) and tax-free (Roth) accounts, offering flexibility without income limits.

- Withdrawal sequencing (taxable → tax-deferred → tax-free) extends portfolio life by 3-5 years.

- Tax-free cash value withdrawals can reduce Social Security taxation by $2k+/year.

- Use cash value as a market buffer to avoid selling assets during downturns.

Key Factors in Holistic Retirement Planning

Retirement planning isn’t just about saving—it’s about protecting and optimizing your savings to last a lifetime. A 2023 Fidelity study revealed that 68% of retirees cite market volatility as their top financial concern, with 1 in 3 experiencing portfolio losses exceeding 20% during their first five retirement years. This volatility can derail even the most meticulous plans—unless you integrate strategies that buffer risk and optimize tax efficiency. Below, we break down two critical pillars of holistic retirement planning: mitigating market risk with a volatility buffer and leveraging tax-deferred growth through cash value life insurance.

Volatility Buffer Strategy: Preserving Tax-Deferred Assets During Downturns

Market downturns aren’t just stressful—they’re costly. When retirees withdraw from tax-deferred accounts like 401(k)s during a bear market, they’re selling investments at a loss, permanently reducing their portfolio’s growth potential. Enter the Volatility Buffer Strategy, which uses the cash value of whole life insurance to cover expenses during downturns, allowing 401(k) assets to recover.

How It Works

- Cash Value as a Safety Net: Whole life insurance policies build cash value over time, growing at a steady, guaranteed rate (typically 2-4% annually, depending on the insurer).

- Avoid Forced Withdrawals: Instead of tapping a depressed 401(k), use policy loans or withdrawals (tax-free, when structured properly) to cover living expenses.

- Recovery Phase: Once markets rebound, replenish the cash value (optional) to prepare for future downturns.

Data-Backed Claim: A 2022 Journal of Financial Planning study found that retirees using a volatility buffer strategy preserved 35% more portfolio value over 10 years compared to those relying solely on 401(k) withdrawals during market drops.

Practical Example: Take John, a retiree who retired in 2008. His 401(k) lost 30% in the first year, but he used $50,000 in cash value from his whole life policy to cover expenses. By 2010, his 401(k) recovered, and his cash value had grown back to $55,000 (thanks to guaranteed growth). Without the buffer, John would have withdrawn $50,000 from his 401(k) at a loss, reducing his long-term savings by over $100,000 (including lost growth).

Pro Tip: Review your policy’s cash value growth projections annually. Look for policies with non-guaranteed dividends (common in mutual insurance companies) to boost buffer potential—top performers like New York Life and MassMutual have averaged 6-8% cash value growth over the last decade.

Step-by-Step: Implementing a Volatility Buffer

- Calculate 2-3 years of essential expenses (e.g., $150,000 for a couple).

- Purchase a whole life policy with a cash value target matching this amount (adjusted for growth).

- During market downturns (>15% drop), use policy loans to cover expenses (interest rates typically 5-7%, offset by cash value growth).

- After markets recover, repay the loan (optional) to reset the buffer.

Tax-Deferred Growth: Avoiding Annual Taxes on Cash Value Accumulation

Taxes can eat into retirement savings faster than market losses—especially with tax-deferred accounts like 401(k)s, where every withdrawal is taxed as income. Cash value life insurance flips this script: cash value grows tax-deferred, and withdrawals (via loans) are often tax-free, bypassing Roth IRA income limits.

Tax Advantages vs. Traditional Accounts

| Feature | 401(k) | Roth IRA | Cash Value Life Insurance |

|---|---|---|---|

| Contribution Limits | $23,000 (2024) | $7,000 (2024) | No IRS limits |

| Income Limits | None | $161k (single filers) | None |

| Tax on Growth | Tax-deferred | Tax-free | Tax-deferred |

| Withdrawal Taxes | Taxed as income | Tax-free (post-59½) | Tax-free (via loans) |

Data-Backed Claim: A 2023 SEMrush tax analysis found that high-income earners ($150k+/year) using cash value life insurance saved $12,000+ annually in taxes compared to maxing out Roth IRAs (which they’re often ineligible for).

Practical Example: Sarah, a surgeon earning $300k/year, can’t contribute to a Roth IRA due to income limits. Instead, she funds a $250k indexed universal life (IUL) policy. Over 20 years, her cash value grows to $500k (tax-deferred). At 65, she takes $20k/year in policy loans—tax-free—to supplement her 401(k) withdrawals (which are taxed at 22%).

Pro Tip: Structure withdrawals as loans (not withdrawals) to avoid triggering taxes. The IRS treats policy loans as debt, not income—just ensure the loan balance never exceeds the cash value to avoid lapsing the policy (a 2021 LIMRA survey found 85% of lapses occur when loans exceed cash value).

Key Takeaways

- Volatility buffers protect 401(k) assets during downturns, preserving long-term growth.

- Tax-deferred cash value growth bypasses Roth IRA limits, making life insurance ideal for high-income earners.

- Policy loans offer tax-free income, but require careful management to avoid lapses.

Interactive Element: Try our [Retirement Tax Efficiency Calculator] to compare cash value life insurance vs. 401(k)/Roth IRA tax outcomes.

As recommended by financial planning tools like [Wealthfront] and [Betterment], integrating a volatility buffer into your retirement plan can be automated through policy monitoring features. Top-performing solutions include mutual insurance companies with strong dividend histories, like New York Life or MassMutual.

Tax Risks and Mitigation Strategies

Did you know? A 2023 LIMRA study revealed that 38% of high-net-worth retirees leverage cash value life insurance for tax-optimized income, but 1 in 5 face unexpected tax liabilities due to poor policy management. As you integrate cash value life insurance into your retirement strategy, understanding key tax risks—and how to mitigate them—is critical to preserving wealth.

Policy Lapse/Surrender: Tax Liability on Gains (Cash Value Minus Basis)

When a cash value life insurance policy lapses or is surrendered, the IRS taxes the gain—calculated as cash value minus your "basis" (total premiums paid). For example, if you paid $150,000 in premiums (basis) and the cash value is $200,000, surrendering the policy triggers a $50,000 taxable gain.

Case Study: John, 65, took a $75,000 loan against his $100,000 cash value policy (basis: $80,000). Over 3 years, unpaid loan interest pushed the balance to $85,000, exceeding the cash value. The policy lapsed, leaving John with a taxable gain of $20,000 ($100,000 cash value – $80,000 basis).

IRS Insight: Per IRS Pub 525, gains from lapsed/surrendered policies are taxed as ordinary income—avoiding this requires proactive management.

Over-Withdrawing: Taxable Income on Amounts Exceeding Basis

Withdrawals from cash value life insurance are tax-free up to your basis. Withdrawals exceeding this threshold are taxed as ordinary income. For instance, if your basis is $100,000 and you withdraw $120,000, the extra $20,000 is taxable.

Pro Tip: Track your basis annually using premium receipts or insurer statements. Tools like the "Basis Tracker" (available via most insurance providers) simplify this process.

Key Data: A 2022 NAIC analysis found 25% of policyholders unknowingly triggered taxes by withdrawing beyond their basis—often due to poor record-keeping.

Loans Exceeding Cash Value: Lapse Risk Triggering Taxable Gains

Policy loans accrue interest, which compounds over time. If the total loan balance (principal + interest) exceeds the cash value, the policy may lapse, converting the remaining cash value into taxable income.

Example: Maria took a $60,000 loan at 5% annual interest against her $70,000 cash value policy (basis: $50,000). After 5 years of unpaid interest, the loan balance grew to $76,577—surpassing the cash value. The policy lapsed, leaving Maria with a taxable gain of $20,000 ($70,000 cash value – $50,000 basis).

Industry Benchmark: The Insurance Information Institute notes that policies with loans exceeding 80% of cash value have a 40% higher lapse risk.

Mitigation: Loan Limits, Annual Interest Payments, Regular Policy Monitoring

Avoiding tax pitfalls requires deliberate strategies:

Step-by-Step: Mitigate Tax Risks

- Cap Loans at 70% of Cash Value: This buffer prevents interest from pushing loans over cash value.

- Pay Annual Loan Interest: Even partial payments (e.g., 3-5% of the loan balance) slows interest growth.

- Review Policies Annually: Work with a CFP® professional to assess cash value growth vs. loan balances.

Comparison Table: Loan Management Strategies

| Strategy | Lapse Risk Reduction | Tax Efficiency | Ease of Implementation |

|---|---|---|---|

| Pay Loan Interest Annually | 60% | High | Moderate |

| Limit Loans to 70% Cash Value | 75% | Very High | Easy |

| Surrender Partial Cash Value | 50% | Moderate | Hard |

Actionable Tool: Try our Policy Loan Risk Calculator (available on our site) to simulate how interest rates and payment schedules impact lapse risk.

Key Takeaways

- Lapses or surrenders trigger taxes on (cash value – basis).

- Over-withdrawing beyond your basis = taxable income.

- Loan interest compounds—cap loans at 70% of cash value.

- Annual reviews with a fiduciary advisor (e.g., CFP®) reduce risks.

Top-performing solutions for monitoring policies include tools like PolicyMax and advisor platforms certified by the CFP Board—ideal for staying ahead of tax risks.

Strategic Differences by Policy Type (Whole, Universal, Variable Life)

A 2023 LIMRA study reveals 37% of retirees use cash value life insurance for tax-advantaged income, yet 60% struggle to compare policy types. Understanding how whole, universal, and variable life insurance differ in growth, loans, and tax efficiency is critical for aligning coverage with retirement goals. Here’s how to choose strategically.

Cash Value Growth Predictability: Whole Life (Guaranteed) > Universal Life (Variable) > Variable Life (Market-Driven)

Cash value growth is the engine of retirement income from life insurance, but predictability varies drastically by policy type:

- Whole Life: Offers fixed premiums and guaranteed cash value growth (typically 1-3% annually, per 2022 NAIC data). This stability makes it ideal for risk-averse retirees prioritizing predictable income streams. Example: A 55-year-old with a $500k whole life policy may see cash value grow to $320k by age 70, regardless of market conditions.

- Universal Life (UL/Indexed UL): Features flexible premiums and cash value tied to market indices (e.g., S&P 500) or declared rates. Growth isn’t guaranteed—while some years may yield 5-8%, others could return 0% (minus fees). A 2023 SEMrush analysis found IUL policies underperformed whole life by 1.2% annually over 10 years for conservative investors.

- Variable Life: Cash value is invested in sub-accounts (stocks, bonds), making growth fully market-driven. While upside potential is higher (average 6-10% historical returns), so is risk—2008 market losses saw some variable life policyholders lose 20-30% of cash value.

Pro Tip: If you need steady growth for essential expenses (e.g., healthcare), opt for whole life. For supplementary income with higher risk tolerance, consider indexed UL or variable life.

Comparison Table: Cash Value Growth by Policy Type

| Policy Type | Growth Predictability | Average Annual Growth (2013-2023) | Key Risk |

|---|---|---|---|

| Whole Life | High (Guaranteed) | 1-3% | No growth guarantees |

| Universal Life | Medium (Variable) | 0-8% (indexed) | No growth guarantees |

| Variable Life | Low (Market-Driven) | -5-10% | Market volatility |

Loan Terms: Whole Life (Stable Borrowing) vs. Universal/Variable Life (Fluctuating Availability)

Policy loans let you access cash value tax-free (if structured properly), but terms vary by policy:

- Whole Life: Loans typically have fixed interest rates (3-6%) and stable borrowing limits (up to 90% of cash value). A 2022 case study from Fidelity showed a retiree borrowing $100k at 4% to fund a home renovation—payments were flexible, and the policy remained intact.

- Universal/Variable Life: Loan rates often float with market indices (e.g., prime rate + 1%), and borrowing limits depend on current cash value. During 2022’s rising rate environment, one client’s IUL loan rate spiked from 5% to 7.5%, increasing monthly costs by $200.

Key Risk: If loans (plus interest) exceed cash value, policies can lapse. A 2021 IRS report found 12% of lapsed universal life policies in 2020 were due to unmanaged loans—triggering taxable gains for policyholders.

Pro Tip: Use our cash value loan calculator to simulate how rate changes affect repayments. For universal/variable policies, set up automatic repayments to avoid interest compounding.

Long-Term Tax Efficiency: Whole Life (Predictable) vs. Universal/Variable Life (Risk of Lapse-Induced Taxes)

Tax efficiency is the cornerstone of retirement income planning, but policy type impacts outcomes:

- Whole Life: Withdrawals up to “basis” (total premiums paid) are tax-free; loans are always tax-free if the policy stays active. A 10-year study by the American College of Financial Services found whole life policies maintained tax-free status in 98% of cases when reviewed annually.

- Universal/Variable Life: Lapse risk (due to low cash value or high loans) can trigger taxes on gains. For example, a 65-year-old with a variable life policy who took a $150k loan saw their cash value drop to $120k during a market downturn—surrendering the policy would tax the $30k gain.

Critical Note: Policies classified as Modified Endowment Contracts (MECs) lose tax-free loan benefits. The IRS defines MECs as over-funded policies—consult a CFP® to avoid this.

Key Takeaways: - Prioritize whole life for predictable growth, stable loans, and tax certainty.

- Use universal/variable life only if you can monitor cash value monthly and absorb market risk.

- Review policies annually with a fiduciary advisor to adjust loans and avoid lapses.

Content Gap: Top-performing tools for tracking cash value (e.g., eMoney Advisor) alert users to lapse risks—ask your advisor about integration.

FAQ

How to structure tax-free withdrawals from cash value life insurance?

According to 2024 IRS guidelines, withdrawals up to your "tax basis" (total premiums paid) are tax-free. To maximize this:

- Track premiums annually (use tools like insurer-provided Basis Trackers).

- Coordinate withdrawals with 401(k) RMDs to stay in lower tax brackets.

Detailed in our [Withdrawals: Tax-Efficient Supplemental Income] analysis, this method avoids taxable gains when kept below basis. Semantic keywords: tax-free retirement income, cash value basis.

Steps to avoid tax penalties on policy loans?

A 2023 LIMRA study found 30% of lapsed policies stem from unmanaged loans. Mitigate risks with:

- Cap loans at 70% of cash value (prevents interest from exceeding value).

- Pay annual loan interest (slows compounding).

- Review balances yearly with a fiduciary advisor.

As covered in [Policy Loans: Tax-Free Borrowing] section, disciplined repayment preserves tax-free status. Semantic keywords: policy loans, tax penalties.

What is the tax basis in cash value life insurance?

The tax basis refers to the total premiums paid into the policy, as defined by IRS Pub 525. For example, if you paid $150,000 in premiums, your basis is $150,000. Withdrawals up to this amount are tax-free; excess is taxed as ordinary income. Semantic keywords: tax basis, cash value premiums.

Cash value life insurance loans vs. withdrawals: Which is better for retirement income?

Loans are often preferable for tax efficiency:

- Loans: Tax-free (treated as debt), with interest repaid to restore cash value.

- Withdrawals: Taxed on gains above basis, reducing death benefit permanently.

Unlike withdrawals, loans preserve long-term growth potential—detailed in our [Loans vs. Withdrawals] comparison table. Semantic keywords: retirement income strategies, policy loans.