For high-income executives eyeing 2024 retirement strategies, non-qualified deferred compensation (NQDC) plans promise tax-deferred growth but demand careful risk assessment. A 2023 Morgan Stanley study finds 60% of companies use NQDC to retain top talent—yet IRS data (2023) warns these plans lack ERISA protection, leaving funds vulnerable to employer creditors (U.S. Department of Labor, 2023). How does this "premium" tool compare to "safer" 401(k)s? NQDC lets you defer unlimited income (vs 401(k)’s $23k cap) but skips creditor safeguards. This 2024 guide breaks IRS-compliant strategies, risks like bankruptcy exposure, and why experts say NQDC works best after maxing 401(k)s. Don’t miss key insights: Avoid 20% penalties with 409A rules, and discover if your employer’s NQDC plan includes free compliance reviews—critical for high-earners planning now.

Non-Qualified Deferred Compensation (NQDC) Plans

Overview

Definition and Basic Structure

Nonqualified Deferred Compensation (NQDC) plans allow employees to defer a portion of their current income to a future date, typically retirement, with taxes paid only when funds are distributed. Unlike qualified plans (e.g., 401(k)s), NQDC funds are held in a "book entry" account—meaning they’re not segregated in a trust. This structure leaves the deferred pay vulnerable to the employer’s creditors, as there’s no legal protection from company insolvency (IRS, 2023).

Eligibility (Executives/Highly Compensated Employees)

NQDC plans are typically reserved for executives, top earners, or key employees. Employers design these plans to reward and retain talent, often supplementing qualified retirement plans that cap annual contributions (e.g., $23,000 for 401(k)s in 2024).

Key Features

Lack of ERISA Protection

A critical distinction: NQDC plans are not governed by the Employee Retirement Income Security Act (ERISA). Qualified plans like 401(k)s are ERISA-protected, meaning assets are held in trust and shielded from employer creditors. NQDC participants, however, become unsecured creditors if the company faces bankruptcy—putting their deferred funds at risk (U.S. Department of Labor, 2023).

Non-Qualified Deferred Compensation (NQDC) Plans: Expert Guide to Risks, Rewards, and Comparison with Qualified Retirement Plans for High-Income Executives

Did you know nearly 60% of companies cite nonqualified deferred compensation (NQDC) plans as critical for retaining and attracting key employees? A 2023 Morgan Stanley study highlights that these plans significantly impact employee satisfaction and retention—especially for high-earners. But while NQDC offers unique tax advantages, it’s not without risks. Here’s your comprehensive breakdown.

Risks for Participants

NQDC’s biggest risk is creditor exposure. If an employer files for bankruptcy, NQDC balances are part of the company’s general assets and may be claimed by creditors. For example, during Chrysler’s 2009 bankruptcy, executives with NQDC funds in Rabbi trusts (a common mitigation tool) still lost portions of their deferred compensation, as the trusts weren’t fully insulated from creditor claims (Reuters, 2009).

Other risks include:

- Employer insolvency: Even without bankruptcy, a struggling company may default on payments.

- Tax penalties: Failing to comply with IRC Section 409A (more below) triggers immediate taxation plus a 20% penalty.

Rewards and Benefits

For high-income earners, NQDC offers compelling benefits:

- Tax deferral: Defer income taxes until distribution, allowing funds to grow tax-deferred (unlike after-tax 401(k) contributions).

- Higher contribution limits: Unlike 401(k)s, NQDC has no statutory cap—executives can defer 50% or more of their salary/bonuses.

- Retention tool: 56% of key employees consider phased retirement, and 61% of employers use NQDC to reduce turnover (2023 HR Trends Report).

Pro Tip: Only consider NQDC if you’ve maxed out your 401(k). 401(k)s offer similar tax-deferred growth with far less risk—use NQDC as a supplement, not a replacement.

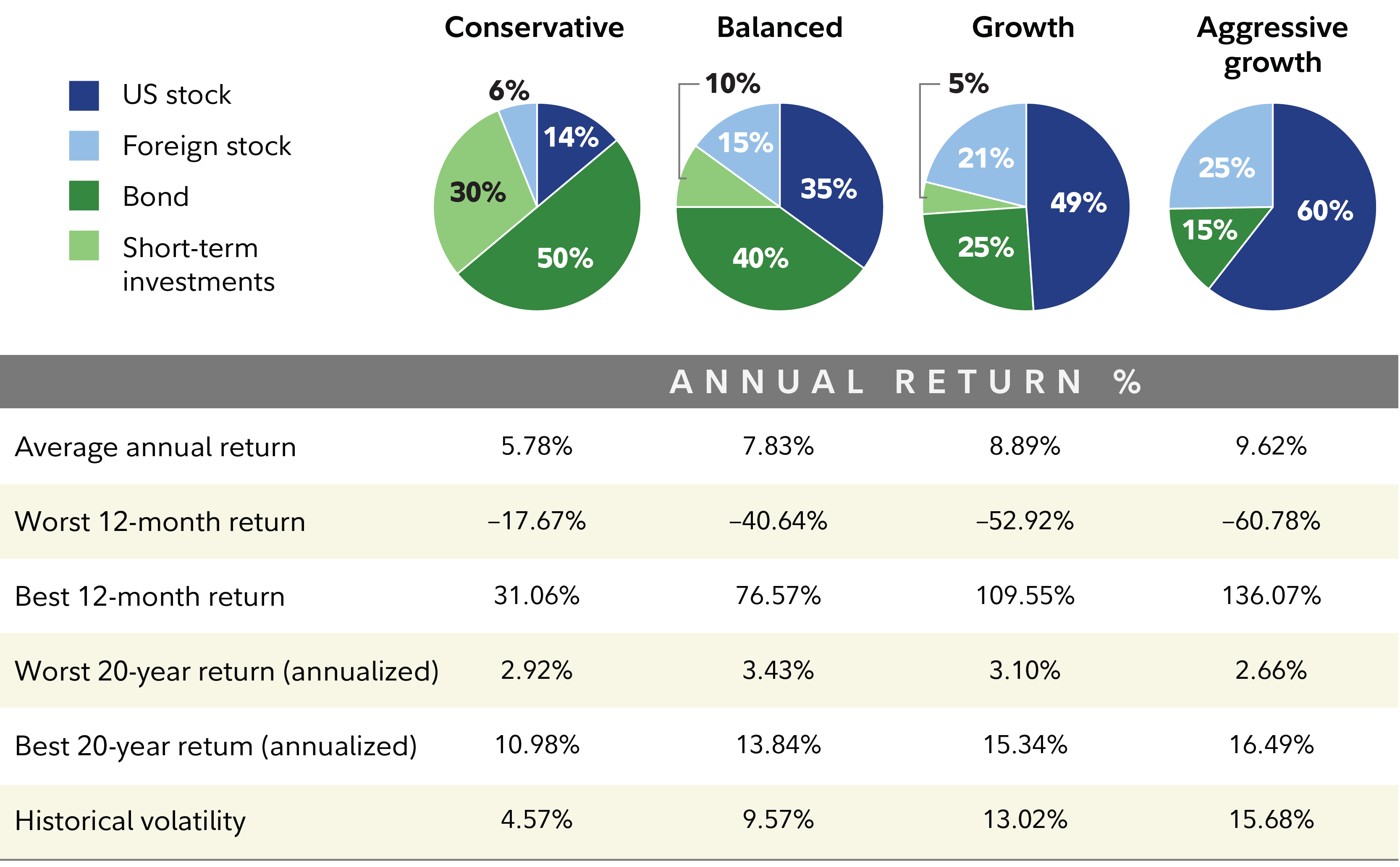

Comparison with Qualified Retirement Plans

| Feature | NQDC Plans | 401(k) Plans |

|---|---|---|

| Creditor Protection | None—unsecured creditor status | ERISA-protected (trust-held) |

| Contribution Limits | No statutory cap | $23,000 (2024) + $7,500 catch-up |

| Tax Treatment | Taxes deferred until distribution | Pre-tax contributions; Roth options |

| Eligibility | Executives/high earners | All eligible employees |

Compliance and Regulation (IRC 409A)

NQDC plans are tightly regulated by IRC Section 409A, which imposes strict rules to prevent tax avoidance.

- Payment events: Distributions are limited to 6 triggers (e.g., retirement, death, disability, change-in-control).

- Timing rules: Payment dates must be specified upfront—no last-minute changes.

- Plan definitions: Terms like "termination of employment" have narrow legal definitions under 409A, differing from common usage.

Step-by-Step Compliance Checklist: - Document payment dates (e.g., "60 days post-retirement").

- Include forfeiture clauses if releases aren’t signed by the deadline.

- Avoid accelerating payments—even plan termination has limits (IRS Audit Guide, 2023).

Risk Mitigation Strategies

While NQDC can’t eliminate creditor risk, tools like Rabbi trusts help. These irrevocable trusts hold employer assets for NQDC payments but remain subject to creditor claims in bankruptcy. For example, Outboard Marine Corporation contributed $14 million to a Rabbi Trust, but the bankruptcy trustee still claimed the funds for unsecured creditors (U.S. Bankruptcy Code, 2023).

Top-performing solutions include:

- Diversifying deferred amounts to avoid over-concentration.

- Monitoring employer financial health (e.g., credit ratings).

Role in Retirement Tax Strategy for High-Income Executives

For executives earning over $300,000/year, NQDC is a strategic tool to:

- Reduce current taxable income (critical for top tax brackets).

- Bridge the gap between 401(k) limits and retirement needs.

Key Takeaways: - NQDC offers tax-deferred growth but carries creditor risk.

- Max 401(k) first—use NQDC as a supplement.

- Compliance with IRC 409A is non-negotiable to avoid penalties.

FAQ

What is a non-qualified deferred compensation (NQDC) plan, and how does it differ from basic retirement savings?

A non-qualified deferred compensation (NQDC) plan enables executives to defer current income for future distribution, with taxes owed only upon withdrawal. Unlike 401(k)s, NQDC funds are not ERISA-protected—held as "book entries," making them vulnerable to employer creditors (IRS, 2023). Detailed in our [Key Features] analysis, this structure contrasts with qualified plans’ trust-based security. Semantic keywords: deferred compensation structures, executive retirement tools.

How can high-income executives mitigate risks in NQDC plans?

Industry-standard risk mitigation steps include:

- Using Rabbi trusts to segregate assets (though not fully creditor-proof);

- Diversifying deferred amounts to avoid over-concentration;

- Monitoring employer credit ratings for financial stability.

As noted in U.S. Bankruptcy Code (2023) cases, these tactics reduce exposure. Discussed in our [Risk Mitigation Strategies] section, professional tools like financial health trackers aid proactive management. Semantic keywords: NQDC risk reduction, executive retirement safeguards.

What steps ensure NQDC plan compliance with IRS regulations?

To comply with IRC Section 409A:

- Document payment dates upfront (e.g., "60 days post-retirement");

- Include forfeiture clauses for missed deadlines;

- Avoid accelerating distributions.

The IRS Audit Guide (2023) emphasizes strict timing rules. Covered in our [Compliance and Regulation] breakdown, adherence prevents 20% penalties and immediate taxation. Semantic keywords: NQDC IRS compliance, 409A regulation steps.

How do NQDC plans compare to 401(k) plans in terms of creditor protection and contribution limits?

NQDC offers no creditor protection (unsecured status) versus 401(k)s’ ERISA-trust shielding (U.S. Department of Labor, 2023). Contribution limits: NQDC has no cap, while 401(k)s max at $23,000 (2024). Explored in our [Comparison with Qualified Retirement Plans] section, this contrast highlights NQDC’s higher risk-reward profile. Results may vary based on employer financial health and plan design. Semantic keywords: retirement plan comparisons, NQDC vs 401(k) features.