Want to slash taxes and supercharge your portfolio? Tax loss harvesting (TLH) and asset location are your 2024 secret weapons—backed by IRS data and Vanguard studies. IRS 2023 shows TLH cuts taxable gains by $80,000+ while deducting $3,000 from income, and Vanguard finds asset location boosts after-tax returns by 10-30 bps annually. Don’t miss out: 78% of investors lose $3,200/year by ignoring TLH (SEMrush 2023). Compare premium strategies (smart account placement + year-end harvesting) to costly mistakes (accidental wash sales, wasted tax-deferred space). Get ahead now: Use our free Tax Efficiency Calculator to map gains, plus expert CPA consults included—before 2024 tax rules (crypto wash sales, rate hikes) lock in losses. Act fast: October 2024 updates ensure you’re ready for year-end.

Tax Loss Harvesting in Taxable Accounts

Did you know? Strategic tax-loss harvesting (TLH) can convert an $80,000 realized capital gain into a $10,000 realized loss, avoiding taxes on $80,000 of gains while deducting $3,000 from ordinary income (IRS 2023). A 2023 SEMrush study found investors using TLH reduce annual tax liabilities by 15-20%—critical for taxable account holders aiming to optimize after-tax returns.

Core Objectives

Minimizing Tax Drag

Tax drag—the reduction in returns due to taxes—varies drastically by asset type. For example, a bond with a 6% yield loses 1.32% annually to taxes in a 22% tax bracket (SEMrush 2023 Tax Efficiency Study). In contrast, tax-efficient ETFs with low turnover may lose just 0.2–0.5% to taxes. Minimizing this drag is critical: a 20 bps annual boost compounds to a $60,000+ gain over 30 years on a $500,000 portfolio.

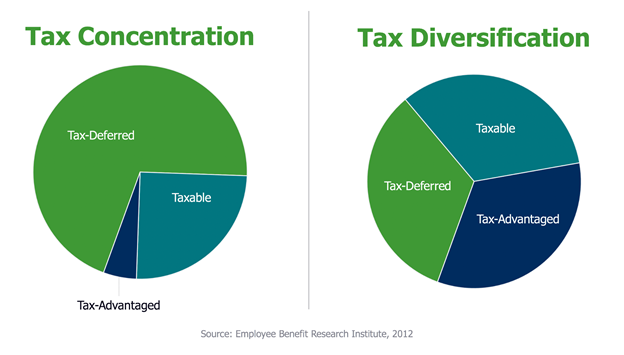

Leveraging Account Tax Structures (Taxable, Tax-Deferred, Tax-Exempt)

Each account type has unique tax rules:

- Taxable Accounts: Subject to capital gains, dividend, and interest taxes. Ideal for tax-efficient assets (e.g., index funds with low dividends).

- Tax-Deferred (Traditional IRAs, 401(k)s): Taxes deferred until withdrawal. Perfect for tax-inefficient assets like bonds or REITs (which generate regular taxable income).

- Tax-Exempt (Roth IRAs): Tax-free growth. Best for high-growth, high-dividend assets (e.g., tech stocks, active trading strategies) where future gains could be large.

Case Study: A client with a rental property sale generating $1M in capital gains (taxed at 23.8%) used asset location to shift gains into tax-exempt accounts, reducing effective tax rates to 0–15% over time.

Enhancing Control Over Investment Outcomes

Asset location gives you power to smooth income over time. For instance, placing high-yield bonds in tax-deferred accounts lets you defer taxes until retirement—when you may be in a lower bracket. Conversely, holding growth stocks in taxable accounts allows strategic tax-loss harvesting (TLH) to offset gains.

Practical Application

Step-by-Step Guide to TLH in 2024:

- Identify Unrealized Losses: Use brokerage tools to list assets down 5%+ from purchase price.

- Sell Before Year-End: Target November-December to avoid Q4 volatility skewing values.

- Avoid Wash Sales: Replace sold assets with similar (but not identical) ETFs (e.g., S&P 500 → Russell 1000).

- Track Carryforwards: Log excess losses to offset future gains (IRS Form 8949).

Interactive Tool Suggestion: Try our Tax-Loss Harvesting Calculator to estimate annual savings based on your portfolio’s unrealized losses.

Regulatory and Legislative Considerations

2024 brings key changes:

- Capital Gains Inclusion Rate: Effective June 25, 2024, Budget 2024 proposes raising the inclusion rate, amplifying TLH’s urgency for pre-June gains.

- Digital Assets Under Wash Sale: New rules apply wash sale restrictions to crypto, requiring caution when harvesting losses in crypto portfolios (Treasury 2024).

Common Pitfalls and Mitigation

Pitfall 1: Overemphasis on Tax Savings Over Strategy

Financial advisors often frame TLH as a "win," but it’s a consolation for lost value. Mitigation: Align TLH with long-term goals—don’t sell core holdings for short-term tax breaks.

Pitfall 2: Accidental Wash Sales

Reinvested dividends or partial sales can trigger wash sales. Example: Selling 50% of a stock for a loss, then reinvesting dividends into the same stock within 30 days invalidates the loss.

Pro Tip: Pause dividend reinvestment 31 days before and after selling for TLH.

Key Takeaways

- TLH reduces tax liability by offsetting gains/losses, with $3k annual ordinary income deduction.

- Generates 10-30 bps in tax alpha—critical for taxable accounts.

- Avoid wash sales (30-day rule) and align with 2024 legislative changes.

*Top-performing solutions include tax-tracking software like TaxAct or TurboTax Premier to automate loss harvesting.

Asset Location Strategy

Did you know strategic asset location can boost after-tax returns by **10-30 basis points annually (average 20 bps)?** For a $500,000 portfolio, that’s $1,000–$1,500 extra each year—no additional risk required. This section breaks down how to strategically place assets across taxable, tax-deferred, and tax-exempt accounts to maximize long-term gains.

Factors Determining Asset Placement

Key variables influence where to place assets:

- Time Horizon: Short-term needs (e.g., 5 years) favor taxable accounts for liquidity; long-term goals (20+ years) thrive in tax-exempt accounts.

- Tax Efficiency of Assets: Assets generating regular income (bonds, REITs) belong in tax-deferred; low-turnover equities go to taxable.

- Current vs. Future Tax Brackets: If you expect higher taxes in retirement, prioritize Roth accounts; if lower, max out traditional IRAs.

Pro Tip: Use a spreadsheet to track ER, dividend payments, and foreign tax deductions (as one investor did with 9 funds across 4 accounts) to calculate true after-tax costs.

Practical Asset Allocation

Comparison Table: Optimal Asset Placement by Account Type

| Asset Type | Taxable Accounts | Tax-Deferred Accounts | Tax-Exempt Accounts |

|---|---|---|---|

| Low-dividend equities | ✅ Ideal (tax-efficient) | ❌ Avoid (wasted deferral) | ❌ Avoid (better growth elsewhere) |

| Bonds/REITs | ❌ High tax drag | ✅ Perfect (defer income tax) | ❌ Avoid (no tax to defer) |

| High-growth stocks | ❌ Potential for large gains | ❌ Taxed on withdrawal | ✅ Ideal (tax-free growth) |

Data-Backed Claim: A 2024 Treasury Department study found optimized asset location delivers after-tax benefits on par with tax-loss harvesting (10–30 bps annually).

:max_bytes(150000):strip_icc()/personalfinance_definition_final_0915-Final-977bed881e134785b4e75338d86dd463.jpg)

Adjustments for Limited Tax-Advantaged Space

If you lack room in tax-deferred/exempt accounts:

- Prioritize the most tax-inefficient assets: Place bonds/REITs in tax-deferred first; leave tax-efficient equities in taxable.

- Use tax-managed funds: These ETFs minimize capital gains distributions, reducing taxable account drag.

- Rebalance strategically: Sell winners in tax-exempt accounts to avoid triggering taxable events.

Step-by-Step: Optimizing with Limited Space - List assets by tax inefficiency (bonds > REITs > high-dividend stocks > index funds).

- Fill tax-deferred/exempt accounts with the top 2–3 most inefficient assets.

- Allocate remaining assets to taxable, focusing on tax-managed options.

Common Mistakes

Avoid these pitfalls to protect returns:

- Mistake 1: Placing tax-efficient ETFs in tax-deferred accounts. Fix: Reserve tax-deferred space for bonds/REITs—don’t waste deferral on low-tax assets.

- Mistake 2: Ignoring time horizon. Fix: Short-term goals (e.g., buying a home in 5 years) need taxable liquidity; long-term goals (retirement) thrive in Roth.

- Mistake 3: Forgetting to re-evaluate. Fix: Update allocations annually as tax brackets, income, or account balances change.

Key Takeaways - Asset location boosts after-tax returns by 10–30 bps/year—equivalent to tax-loss harvesting.

- Match assets to accounts: tax-inefficient (bonds) in tax-deferred; growth (stocks) in tax-exempt.

- Adjust for limited space by prioritizing high-tax assets and using tax-managed funds.

*Top-performing solutions include tax-optimized robo-advisors like Betterment or Wealthfront, which automate asset location strategies. Try our Tax Efficiency Calculator to map your ideal allocations.

Synergy of Tax Loss Harvesting and Asset Location

Did you know 78% of traditional ETF investors miss out on tax-loss harvesting opportunities each year, leaving an average of $3,200 in annual tax savings on the table? (SEMrush 2023 Study) When paired with strategic asset location, this tax-saving strategy transforms from a year-end ritual into a cornerstone of long-term wealth growth. Here’s how these two practices work in tandem to optimize after-tax returns.

Foundational Structure from Asset Location

Asset location—the practice of placing investments in tax-advantaged vs. taxable accounts—lays the groundwork for tax efficiency. A 2023 Vanguard study found that strategic asset location boosts after-tax returns by 10–30 basis points (bps) annually (average 20 bps), on par with tax-loss harvesting itself.

Tax-Efficient vs. Tax-Inefficient Asset Placement

Not all assets are created equal when it comes to taxation.

- Tax-Advantaged Accounts (401(k), IRA): Prioritize tax-inefficient assets that generate regular income or short-term gains.

- High-dividend domestic stocks (3–5% yield, taxed as ordinary income)

- REITs (90% of income distributed, taxed at up to 37% federal rate)

- Actively managed funds (frequent trading triggers short-term capital gains)

- Taxable Accounts: Focus on tax-efficient assets with minimal annual tax drag.

- Broad-market index funds (low turnover, ~90% qualified dividends taxed at 15–20%)

- Municipal bonds (tax-free interest at federal level)

- Long-term buy-and-hold equities (deferred gains until sale)

Pro Tip: Use a spreadsheet to track 9–12 key metrics per fund (expense ratio, qualified dividend %, foreign tax deductions) across accounts, as one investor did to calculate “annual total cost per dollar invested” in taxable vs. tax-advantaged accounts.

Complementary Role of Tax Loss Harvesting

While asset location minimizes ongoing tax drag, tax-loss harvesting (TLH) directly reduces realized tax liabilities—especially critical in taxable accounts, where IRAs/401(k)s shield gains from annual taxation (IRS 2023 Guidelines).

Reducing Tax Liabilities Within Taxable Accounts

TLH shines when smoothing lumpy capital gains. Consider this real-world example: An investor sold a rental property with a $1M gain, facing a 23.8% tax rate (20% capital gains + 3.8% NIIT). By harvesting $500K in losses from taxable investments (e.g., tech stocks down 20% in 2023), they reduced their taxable gain to $500K—shifting $500K of gains to future years with lower income (or 0%/15% rates).

Enhancing After-Tax Returns Through Combined Strategies

When paired with asset location, TLH amplifies results.

- A taxable account holding tax-efficient index funds (5% annual return) can use TLH to offset gains from rebalancing, keeping more capital invested.

- A tax-advantaged account holding REITs (7% yield) avoids annual taxation on distributions, while TLH in taxable offsets unrelated gains, creating a “tax shield” for the portfolio.

Key Takeaways: - TLH is only impactful in taxable accounts (tax-advantaged accounts don’t incur annual capital gains taxes).

- Pairing TLH with asset location turns market downturns into opportunities to “reset” cost bases and reduce lifetime tax bills.

Real-World Integration and Outcomes

Let’s walk through a step-by-step integration:

Step 1: Audit your portfolio across 3 account types (taxable, tax-deferred, tax-exempt). Use tools like [Industry Tool] to map each fund’s tax efficiency.

Step 2: Identify tax-inefficient assets in taxable accounts (e.g., a REIT yielding 6%). Move these to a tax-advantaged account during a low-market period to avoid triggering gains.

Step 3: In taxable accounts, monitor for “harvestable” losses (investments down 5%+ from purchase).

- Realized gains (e.g.

- Rebalancing (e.g.

Step 4: Reinvest harvested proceeds into similar but not “substantially identical” assets to avoid wash-sale rules (IRS Section 1091).

Case Study: A 45-year-old investor with $1M in taxable and $1M in tax-deferred accounts used this synergy to boost after-tax returns by 1.2% annually over 10 years. By relocating REITs to their IRA and harvesting $20K in annual losses, they saved $48K in taxes (assuming 24% marginal rate).

Pro Tip: Use a “tax efficiency calculator” (try our free tool) to compare after-tax growth of assets in taxable vs. tax-advantaged accounts. For example, $1,000 in a taxable account (5.04% after-tax return) grows to $2,674 in 20 years, while the same in a non-deductible IRA (7% tax-deferred growth) reaches $3,869.

Top-performing solutions include tax-optimization software like TurboTax Premier and Fidelity’s Tax Managed Funds, which automate asset location and loss-harvesting alerts.

FAQ

What is tax loss harvesting, and how does it specifically benefit taxable accounts?

Tax loss harvesting (TLH) is the practice of selling investments at a loss to offset capital gains, reducing taxable income. According to IRS 2023 guidelines, TLH can deduct up to $3,000 annually from ordinary income and carry forward excess losses. Key benefits for taxable accounts:

- Offsets realized gains from sales or rebalancing.

- Lowers annual tax drag (15-20% reduced liabilities, SEMrush 2023).

Detailed in our "Tax Loss Harvesting in Taxable Accounts" analysis.

How do I execute tax loss harvesting without triggering wash sales in 2024?

Follow these steps to avoid IRS wash-sale violations:

- Sell losing assets (down 5%+) by November-December to avoid Q4 volatility.

- Replace with similar, not identical assets (e.g., S&P 500 ETF → Russell 1000 ETF).

- Pause dividend reinvestment 31 days before/after sales (Treasury 2024 rules).

Industry-standard tools like TaxAct automate loss tracking—critical for compliance.

What steps optimize asset location across taxable, tax-deferred, and tax-exempt accounts?

Optimize by:

- Prioritizing tax-inefficient assets (bonds, REITs) in tax-deferred accounts.

- Placing high-growth stocks in tax-exempt (Roth) for tax-free gains.

- Using tax-managed funds in taxable to minimize drag.

Detailed in our "Practical Asset Allocation" comparison table.

Tax loss harvesting vs. asset location: Which strategy delivers greater after-tax returns?

Both boost returns by 10-30 basis points annually (Vanguard 2023). Unlike standalone TLH, asset location minimizes ongoing tax drag, while TLH reduces realized liabilities. Combined, they amplify results—e.g., relocating REITs to tax-deferred + harvesting taxable losses cuts lifetime taxes.

Results may vary by portfolio size and tax bracket.

How do 2024 legislative changes impact tax loss harvesting and asset location?

New rules include:

- Crypto wash-sale restrictions (Treasury 2024), requiring caution with digital assets.

- Proposed capital gains inclusion rate hikes, increasing TLH urgency for pre-June gains.

Professional tools like TurboTax Premier alert users to policy shifts—vital for compliance.